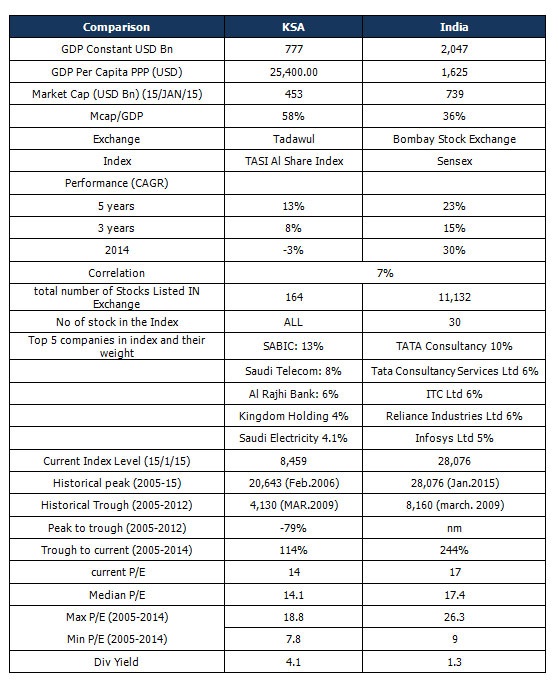

This is a strange pair of two markets, Saudi Arabia and India. One is a rich oil producer sitting on huge amount of wealth and is 7 times richer than India on a per capita basis. Another is a growing emerging market three times the size of Saudi Arabia.

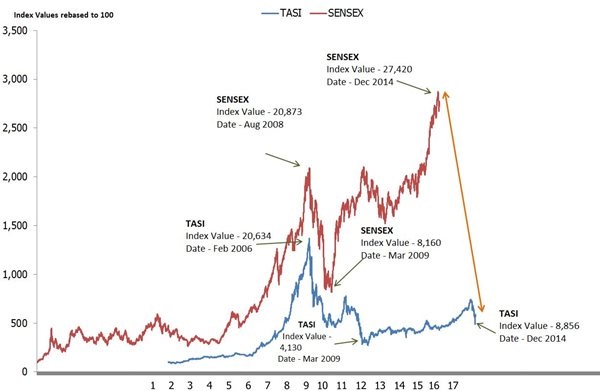

On the 31st of January 2005 the TASI index was at a modest 8,231 points while the SENSEX was at its modest 6,555 points. Since that date the TASI index peaked at 20,643 points on February 2006 while the SENSEX peaked to 20,873 points on August 2008. The global credit crisis in 2008 brought them down together (as they did to all the markets in the world) with their bottoms reaching during February 2009 shedding 79% and 56% respectively (from peak) of their values. However since that date SENSEX bounced back to post a return of over 200% while Saudi Arabia totters. This has created a chasm between the two markets in terms of long term returns. During the last 5 years, Sensex produced an annualized return of 23% against an annualized return of 13.5% for Saudi Arabia.

Obviously this bounce back for India has produced some valuation excesses compared to Saudi Arabia. India currently trades at a p/e level of 17 (median is 17.4) while Saudi Arabia trades at 14 (median 14). Due to low valuation, Saudi offers better dividend yield (4.1%) compared to India’s 1.3%.

For the future, the following scenarios emerge:

- The differential gap narrows with Saudi rising and India staying put or falling

- The differential gap widens with India keeping up the bull momentum and Saudi straying sideways as has been the trend of late

- The differential gap stays put with either both markets witnessing upward moment or both markets witnessing side way movement.

2 years ago we suggested the above scenarios – fast forwarding today, the Indian market remains on its bull trajectory and the differential gap widened while Saudi remained tottering sideways on the back of a collapsing oil market and an endearing geopolitical risk from neighbouring countries.

Stay Tuned To Marmore MENA Insights!

Never miss a patch or an update with Marmore's Newsletter. Subscribe now!

Related Article

2024 Kuwait Banking: Interest Rates and NIM Trend Analysis

The blog discusses how net interest margin of Kuwaits banks has moved across interest rate cycles, in light of awaited policy rate cuts.

Read MoreAre ESG and Sustainable investing the same?

ESG and Sustainable Investing might seem to be related but both are distinct concepts. The GCC nations transition towards cleaner energy portrays a buoyant outlook for ESG and sustainable investing.

Read MoreBusiness Impact of IFRS Sustainability Standards for GCC

The impact of the recently issued IFRS sustainability standards, once adopted, is likely to be high, as GCC companies scramble to allocate adequate resources for the adoption.

Read More