Kuwait Projects: KWD 10bn Awarded - Where is the trickle-down effect?

Marmore Team

07 April 2016

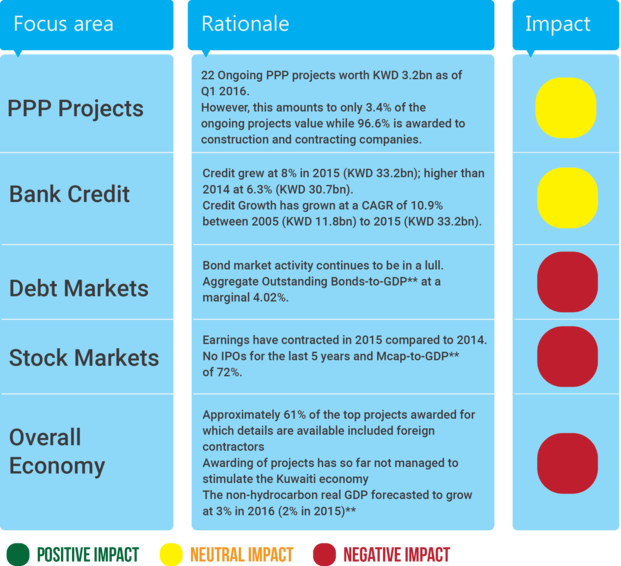

According to Marmore’s recently published report on Kuwait Projects, in 2015, Kuwait awarded projects worth KWD 10bn, an increase of 20% compared to 2014. The aggregate value of projects awarded during 2014 and 2015 was KWD 18bn. However, this is yet to impact positively on key areas of the economy.

Projects Impact Indicator

Source: Marmore; * World Bank estimates, **As per IIF, 2015 nominal GDP of Kuwait – USD 121.1bn

As of Q1 2016, there are 420 ongoing projects in Kuwait, 19 projects valued at KWD 34bn (USD 112.2bn) placed on hold and another 20 projects valued at KWD 7bn (USD 22.1bn) shelved. Some of the key areas that were expected to be positively impacted are the banking (liquidity & credit growth) and capital markets (debt & equity). However, the awarding of projects is yet to create any impact on capital markets and had a marginal impact on banks’ credit growth. Bank’s credit, which was expected to be significantly impacted, grew with 8% increase in credit growth at the end of 2015 compared to 2014. And, the corporate earnings in Kuwait have contracted at the end of 2015 compared to 2014. All these factors ascertain that the awarding of projects during 2014 and 2015 is yet to stimulate the growth of the Kuwaiti economy as anticipated.

The reasons highlighted in the report for the absence of tangible effects of these projects are:

– In the current situation, much of the projects went to contracting and construction companies rather than PPP. A PPP focused project awards can have quick pass through effect benefitting many legs of the economy.

– Duration taken for the projects to be completed: Considering some of the largest (in terms of value) projects completed during the 2012 to 2015 periods, the average duration taken for these projects to be completed was 5 years

– The contra effect of the low oil price on economy: As the positive effect of the projects awarded is weathered by the negative impact of low oil prices on the economy

– Projects awarded are skewed towards oil & gas sector – A majority of the completed projects are from oil & gas sector and since Kuwait is an oil-dependent economy, the economic significance of these projects is high. However, given the lower oil price prevailing since mid-2014, this would not have resulted in expected level of revenue generation

Some of the trends summarized in the report are that projects awarded are showing signs of growth with the increase from KWD 3bn in 2012 to KWD 10bn in 2015 and the decline in oil prices hasn’t significantly impacted the project’s landscape in Kuwait.

A sector wise assessment indicates that the real estate sector is the most dominant segment for projects in Kuwait with the highest number of ongoing projects (154) worth KWD 37bn. However, Oil & gas, power & water sector projects accounted for 74% of projects completed (by value) between 2012 and 2015. As far the new projects are concerned almost 50% of the projects signed in 2015 belong to the oil and gas sector. A majority of the ongoing projects in Kuwait are in the early stages of execution.

The Kuwait Authority of Partnership Projects (KAPP), is expected to award PPP projects worth KWD 2bn (USD 6.6bn) in 2016 and as of Q1 2016, there are 22 ongoing projects from real estate and power & water sectors. The Al Zour IWPP is the largest ongoing PPP project in Kuwait.

Stay Tuned To Marmore MENA Insights!

Never miss a patch or an update with Marmore's Newsletter. Subscribe now!

Related Article

2024 Kuwait Banking: Interest Rates and NIM Trend Analysis

The blog discusses how net interest margin of Kuwaits banks has moved across interest rate cycles, in light of awaited policy rate cuts.

Read MoreAre ESG and Sustainable investing the same?

ESG and Sustainable Investing might seem to be related but both are distinct concepts. The GCC nations transition towards cleaner energy portrays a buoyant outlook for ESG and sustainable investing.

Read MoreBusiness Impact of IFRS Sustainability Standards for GCC

The impact of the recently issued IFRS sustainability standards, once adopted, is likely to be high, as GCC companies scramble to allocate adequate resources for the adoption.

Read More