The blazing summer heat encouraged the yearly migration of GCC tourists to cooler locations. These past few years this “summer hibernation” has coincided with the holy month of Ramadan, which acts as a double whammy for stock markets in the region. And if that wasn’t enough, the lifting of Iran sanctions sent oil prices tumbling down, with IPE Brent falling 17.9% to USD 52 in July, and the sell-off in the Chinese markets had a pronounced impact in the region. The Chinese economy is tottering at the edges, as the domestic demand is yet to be stoked to levels that would allow for the domestic consumption driven structural change.

The recent decision by US and the Eurozone countries to lift the economic sanctions imposed on Iran few years ago has opened an interesting dynamic in the oil market. According to the Iran oil ministry, the lifting of sanctions would result in Iran adding 500,000 barrels a day within a week after sanctions end and by 1 million barrels a day within a month to the global production. With the OPEC members not cutting down on their output, and indeed shoring and expanding facilities to increase production, like in Saudi and Kuwait, it remains to be seen how deep would the oil price fall in the coming months as the supply glut intensifies.

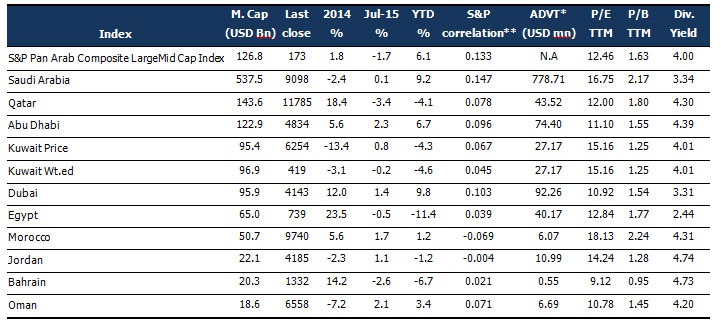

Overall, MENA market performance lacked positive triggers. Qatar had the worst performance shedding 3.4%, while Abu Dhabi, the leader of the pack, posted a 2.3% gain. The Abu Dhabi index was one of the rare bright sparks in the region for the month of July, as positive earnings results among banking stocks buoyed market performance.

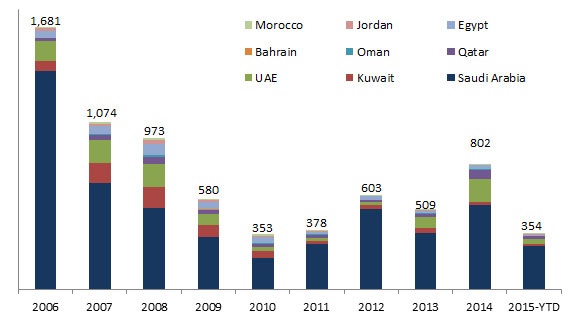

Post-Eid celebrations, trading activity picked up in the markets especially in the small cap segment. But across the spectrum, MENA markets saw dwindling value and volume traded in July (29% and -33%, respectively).

Compared to 2014, value traded has to play catch up as the first 7 month of 2015 has yielded only 44% of the value from last year. That said, the star performance so far has been Dubai, with a 9.8% YTD gain and room for further improvements, since it is trading below its GCC peers at 10.9x.

MENA Liquidity, in USD billion, 2006-Present

Source: “The Month That Was” Marmore MENA intelligence

MENA markets in July 2015

Source: “The Month That Was” Marmore MENA intelligence

MENA markets are a long way from their last peak prices, with the exception of Qatar which is inching closer to its decade high. Dubai stock market had a stellar performance over the past few years; in 2013 the market doubled, while in 2014 Dubai closed the year with 12% gain. Dubai still can scale and create a new high, given continued positive earnings and strong spending by the state.

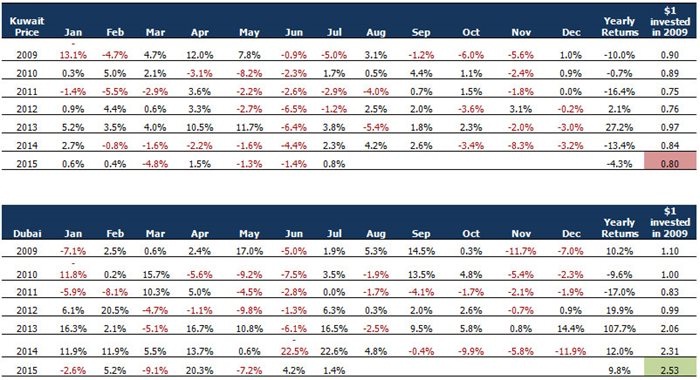

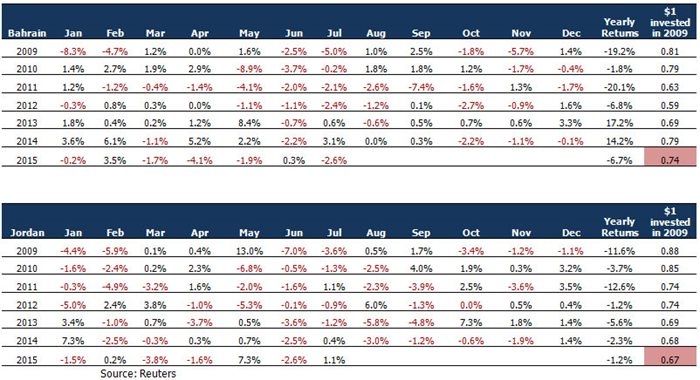

Post-crash return

What happens to your money if you had invested in MENA indices during the crash? The following tables give you an idea of returns if one had invested a dollar in each of the markets in 2009. For example, if you invested a dollar in Dubai, you would receive $2.53, a 153% return. However, if you had invested the same amount in Jordan, today you will have netted $0.67 (i.e) a 33% loss. While some conclude that GCC markets are more resilient than MENA markets, they would be wrong as a dollar invested in Bahrain and Kuwait Price index would have seen a loss of 26% and 20%, respectively.

Overall, MENA markets lacked positive triggers in July, and the next month is also expected to be slow, as the business community and the government sector are still in the “summer hibernation mode”. One thing to watch out for is the impact of entry of Iran oil on an already saturated market, and China’s dwindling growth.

Stay Tuned To Marmore MENA Insights!

Never miss a patch or an update with Marmore's Newsletter. Subscribe now!

Related Article

2024 Kuwait Banking: Interest Rates and NIM Trend Analysis

The blog discusses how net interest margin of Kuwaits banks has moved across interest rate cycles, in light of awaited policy rate cuts.

Read MoreAre ESG and Sustainable investing the same?

ESG and Sustainable Investing might seem to be related but both are distinct concepts. The GCC nations transition towards cleaner energy portrays a buoyant outlook for ESG and sustainable investing.

Read MoreBusiness Impact of IFRS Sustainability Standards for GCC

The impact of the recently issued IFRS sustainability standards, once adopted, is likely to be high, as GCC companies scramble to allocate adequate resources for the adoption.

Read More