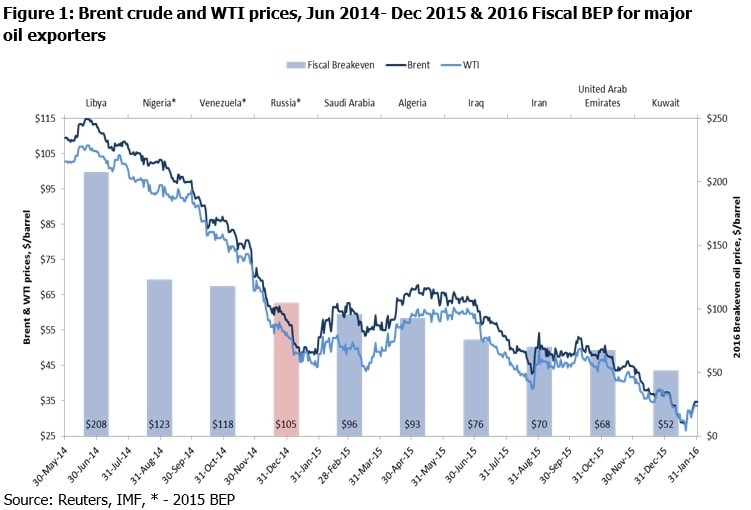

With the oil price hovering around $35 per barrel the question remains as to how much longer can OPEC continue with its current policy of pumping as much oil as it can in a quest to win more market share and drive out high cost producers. OPEC member countries produce around 37% of the global crude oil, and disagreements over production ceilings have already affected some of the members. Some of the big producers, such as Venezuela, Nigeria and Algeria that rely on oil exports for their revenue, do not have the luxury of oil surpluses, and are facing widening fiscal and current account deficits. Even for GCC exporters, assuming low oil prices persist, public foreign assets could decline substantially over the next 5 years, while gross public debt could rise to 59% of GDP.

After clocking more than a trillion dollars annually in export revenues during the period 2012-2014, GCC economies will witness a 23% fall in export revenues in 2015 mainly driven by Saudi Arabia, which accounts for close to half the estimated USD 250bn loss. Lower revenues for the government along with weakening balance sheets could spill over to the broader economy, if the situation persists over a longer time frame.

Fed Rate Hike

US interest rates were finally hiked by 25bps on 16 Dec 2015, with the Fed raising the range of its benchmark interest rate by a quarter of a percentage point to between 0.25% and 0.50%, and further rate hikes expected in 2016, with the median projected target of 1.375%. Barring Qatar, other GCC countries followed the monetary policy cues issued by the US Fed, for the most part, but will this conformity continue going forward is anybody’s guess.

Some GCC countries have rejected notions of moving away from the US peg, which implies that monetary policy cues will continue to be taken from the Fed. But the extent of this could be dictated by local economic conditions, as countries such as Oman and Saudi continue facing currency pressures.

Wobbly China

China’s borrowing binge post the 2008 global financial crisis has led to burgeoning rise in credit, which rose from 134% of GDP in 2007 to 240% of GDP at the end of Q3 2015, and a period of slow economic growth only magnifies the indebtedness. China's banking regulator has claimed that new non-performing loans (NPL) held by Chinese banks more than doubled in 2015 from the previous year.

Depreciation of the yuan puts pressure on other central banks around the world to push down their own currencies to help their own exporters and to prevent destabilizing capital flows. According to various sources, China is mulling a 15%-20% devaluation of its currency by the end of 2016, and economic slowdown, coupled with depreciating yuan, is expected to lead to further capital outflows from China.

GCC trade with China grew more rapidly during 2010-13 than with any other significant trade partner, at a rate of over 30% for exports and 17% for imports. How China fares in 2016 will have far-reaching consequences across the globe, and especially in the GCC.

Emerging Market Crises

Investors are exiting debt-laden emerging markets, having pulled out close to $30.5 billion from Asian stock and debt markets by the end of Nov 2015; the largest outflow since the financial crisis. Lending conditions have begun to tighten, which when combined with deteriorating corporate profits, puts a question mark on the refinancing of existing debt, $600 billion of which is maturing in 2016.

A wave of currency devaluationas have affected the emerging markets, with China, Vietnam, Thailand etc. lowering their currencies against the US dollar, in order to make their exports more competitive. Many EM currencies are also vulnerable due to weak macroeconomic fundamentals, and rising capital outflows, with Greece, South Africa, Argentina, Hungary and Turkey at the precipice of another crisis.

Commodity producing nations are at a higher risk, but countries with sufficient domestic demand, such as India and Philippines are expected to be better off. But the overall scenario in emerging markets points towards a slowdown and not a meltdown.

Geopolitical Risks

With rising geopolitical issues in the region, weapons imports have risen, with Saudi Arabia now receiving 7% of international arms imports, second only to India (14%). Saudi Arabia’s arms imports have rocketed by 275% in the last five years, and the country’s military expenditure is among the top 5 in the world. Geopolitical tensions also cause social unrest such as those that occurred during the Arab Spring. Need for social appeasement will make the task of cutting subsidies difficult for many countries in the region.

Recently, Standard & Poor's cut ratings and outlook of several oil producing countries in the Middle East, including Saudi Arabia, when the GCC nations are planning to issue bonds in both domestic and international markets to bridge the widening deficit. Worsening geopolitics would increase cost of capital for both sovereign and corporates. Another major fallout would be the fall in perception of GCC, among multi-nationals who wish to capitalize on the fast growth witnessed thus far.

Stay Tuned To Marmore MENA Insights!

Never miss a patch or an update with Marmore's Newsletter. Subscribe now!

Related Article

2024 Kuwait Banking: Interest Rates and NIM Trend Analysis

The blog discusses how net interest margin of Kuwaits banks has moved across interest rate cycles, in light of awaited policy rate cuts.

Read MoreAre ESG and Sustainable investing the same?

ESG and Sustainable Investing might seem to be related but both are distinct concepts. The GCC nations transition towards cleaner energy portrays a buoyant outlook for ESG and sustainable investing.

Read MoreBusiness Impact of IFRS Sustainability Standards for GCC

The impact of the recently issued IFRS sustainability standards, once adopted, is likely to be high, as GCC companies scramble to allocate adequate resources for the adoption.

Read More