Debt Management Offices in GCC - A great institutional step

Marmore Team

17 January 2018

GCC governments have been active in setting up Debt Management Offices (DMO) in order to better understand and service their debt obligations. Hitherto, the role of issuing debt, servicing them and repaying them were all taken care of by the respective central banks. While that might have worked when the debt were minimal, a specialist DMO is required in order to manage them by establishing a separate, independent entity that is in charge of the debt management to avoid the burden on the central banks. GCC countries have established a Debt Management Office (DMO) that is independent but act according to the limits set by the finance ministry. DMO and treasury act in a co-ordinated manner and their collaboration relieves the central bank of such duties and it could concentrate on its most important functions.

In the GCC region, Dubai, Abu Dhabi, Kuwait, Qatar, Oman and Saudi Arabia have set up their debt management offices in order to perform the cash management functions of the government. They take care of the cash requirements of the government; borrowing funds when there is a shortfall and placing the funds when they have a surplus. In the larger sense, the DMO functions as the executive arm of the treasury/central bank of these governments. Each of these offices is structured differently and has various levels of roles and responsibilities. The governments of the region have also been very eager to raise funds from international markets, taking advantage of the prevailing low interest rates globally.

The Dubai Debt Management Office

The Dubai DMO works under the supervision of the Dubai Supreme Fiscal Committee. One of the main objectives is to provide financial support and liquidity to government projects in support of the Financial Strategic Plan which has the objective of promoting economic development in the Emirate. The debt management division effectively has two sections an investor relation section and an operations section. The overall DMO falls under the purview of the Director General of the Government of Dubai’s Department of Finance.

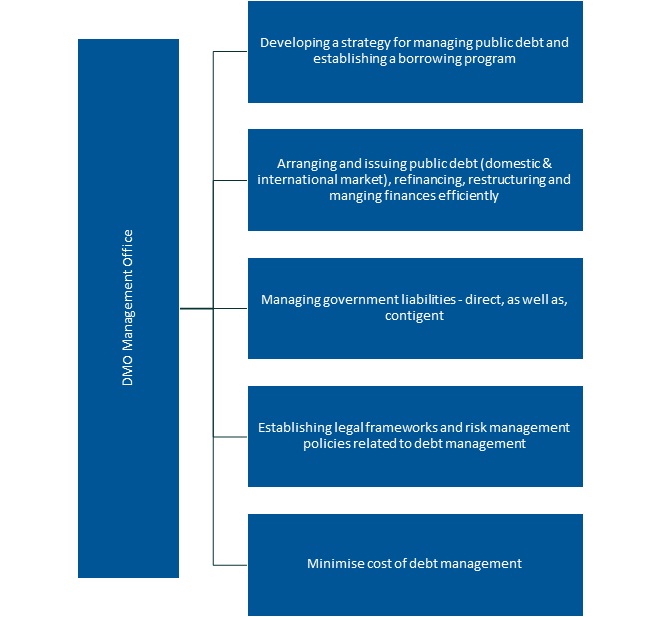

Roles & Responsibility of DMO

Saudi Arabia Debt Management Office

The Saudi Arabia Debt Management Office was established in the fourth quarter of 2015 following the decline in oil prices and the government’s intention to raise funds in its domestic and international market. The DMO was established with the objective of securing funds for the short, medium and long term finance needs within a pre-established risk framework. Saudi Arabia DMO is bequeathed with other responsibilities as well, such as managing the direct and contingent liabilities of the government, developing a medium term debt strategy, arranging, leading and issuing public debt in all forms (both local and international borrowing), developing the legal frameworks, governance, risk management policies that is related to public debt management.

Kuwait Debt Management Office

Kuwait has been the most recent country among the GCC nations to setup a debt management unit under Ministry of Finance and has been recently been noted down as a key reform measure by Moody’s that would help the country in the long-run.

In countries that have a dedicated office for debt management, the DMO comes under the purview of the department of finance. DMOs in the GCC region should have to take into consideration that too much public debt with local banks could result in crowding-out of credit to the private sector. Alternatively, government debt issuance could facilitate deepening of the local capital markets, diversifying funding sources and benchmarking the yield curve for corporate financing (GCC Surveillance Paper).

Why setting up a DMO is necessary for GCC countries now?

Until 2014, GCC countries did not face any significant funding gaps, and they didn’t have the need to develop any expertise in public debt management – until the steep fall in oil prices caused fiscal deficits, as the government had to borrow more than the revenues it received from oil receipts. Since then, the oil market has undergone a lot of turmoil which has resulted in a significant change in the way the debt has started to form an essential part of the GCC government funds. In the initial phases a lot of the government debt that was issued was absorbed by the local banks. However, most GCC governments took cognisance of the fact that parking too much of the issuances with local banks were crowding out the private sector and started going for international issuances.

With more funds expected to be raised using bond issuances route, it is of vital importance that GCC countries have a specialist organization that would be looking into the debt issuances and managing them instead of the central banks. In this regard, IMF provides certain action points on how to achieve them. In fact, in 2016 they had helped Saudi Arabia to help setup a DMO for managing future borrowing and Issuances.

- Establish a DMO under the Ministry of Finance that would be responsible for developing the legal, governance, and risk management frameworks for debt management;

- Develop a medium-term debt strategy to properly assess the trade-offs of alternative debt strategies in light of the expected fiscal deficits over the medium term; and

- Promote debt management policies and practices that facilitate local debt market development, such as using auctions as issuance mechanisms and adopting efficient communication channels with market participants.

- Give regular updates in about the debt issuances, open market operations, auction schedules in both English and Arabic

- Perform regular conference calls with investors to address investor concerns.

Implement a strict timeline for addressing the query of investors.

Stay Tuned To Marmore MENA Insights!

Never miss a patch or an update with Marmore's Newsletter. Subscribe now!

Related Article

2024 Kuwait Banking: Interest Rates and NIM Trend Analysis

The blog discusses how net interest margin of Kuwaits banks has moved across interest rate cycles, in light of awaited policy rate cuts.

Read MoreAre ESG and Sustainable investing the same?

ESG and Sustainable Investing might seem to be related but both are distinct concepts. The GCC nations transition towards cleaner energy portrays a buoyant outlook for ESG and sustainable investing.

Read MoreBusiness Impact of IFRS Sustainability Standards for GCC

The impact of the recently issued IFRS sustainability standards, once adopted, is likely to be high, as GCC companies scramble to allocate adequate resources for the adoption.

Read More