The 2020 stock market crash due to Covid-19 has been fast and short, if the markets do not fall to the lows of March 2020 again. The Oil price crash and social distancing measures to prevent the spread of Covid-19 has impacted sectors in the GCC in different ways.This can be observed in the current level of GCC Sector Indices. We make a comparison of the current levels of GCC sector indices with that of 52-week high and 52-week lowto check which sectorsare good bets in these uncertain times.

Ad: Marmore Research Report[/caption]

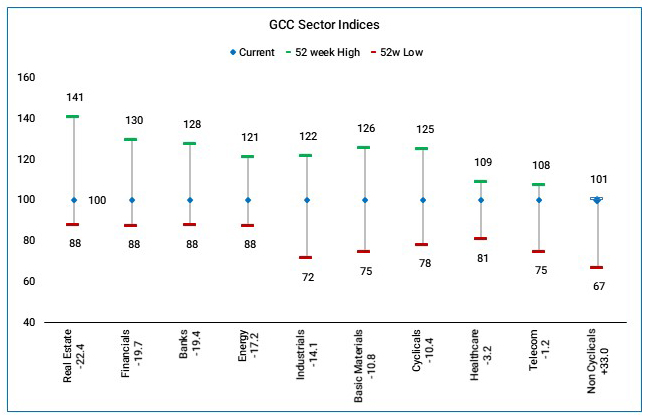

Exhibit 1: GCC Sector Indices along with their 52 week High and 52 week low

Source: Refinitiv; Data as of June 17, 2020. Note: Current values rebased to 100. 52 week high and low are shown relative to current price Year-to-date price performance shown along with X-axis labels

Real estate, Banks & Financials and Energy indices have seen huge falls

As a region with a primarily oil-based economy, GCC equity markets have been affected by the Oil price crash. This has resulted in a huge fall for the GCC Energy index which has fallen 17.2% for the year till date (YTD). However, the lockdowns, interest payment deferrals and travel restrictions instituted by the GCC nations to contain the spread of COVID-19 have affected the Real estate (down 22.4% YTD) and Financials (down 19.7% YTD) indices by even greater levels. Since these sectors constitute a significant percentage of the S&P GCC Composite, the whole index has been affected.

Are Defensive Sectors a great bet during these times?

The downturn has increased the need for fund managers and investors to look at defensive stocks. Defensive stocks are those which perform well even during periods of crisis. Defensive stocks generally provide stable earnings inspite of the underlying economic conditions. Their businesses also tend to provide products or services that are in demand even during recessions. Examples of such sectors are consumer staples, consumer discretionary and Utilities. We can observe that the GCC Non-Cyclicals index trades at very close to the 52 week high and has also gained 33% YTD as against the S&P GCC composite index which has fallen 15.2% YTD. This indicates that defensives are a great investment bet in uncertain times.

Did You Know?

Other sectors which can be considered to be defensives like telecom have also outperformed the S&P GCC composite index with the GCC telecom index only being down 1.2% for the year and trading very close to the 52 week high. With increased internet data usage due to people being confined to their homes during the lockdown, telecom companies are expected to benefit from the crisis. In the long run also, with e-learning and work from home expected to increase, telecom sector is also expected to outperform the market.

Another index to significantly outperform the S&P GCC Composite is the GCC Healthcare index which has fallen by 3.2% YTD. The Covid-19 pandemic has seen an increased focus on the healthcare sector in the near term. The long term prospects for the sector also look good as GCC Governments are likely to increase healthcare spendingeven after the pandemic ends.

Defensive sectors constitute a relatively small portion of the S&P GCC composite index

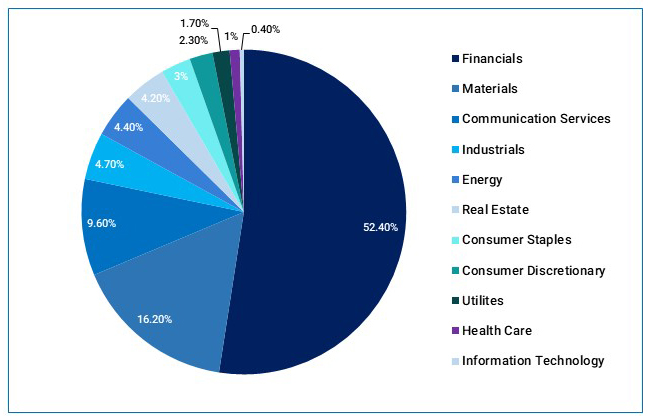

Exhibit 2: Sectoral Breakdown of S&P GCC Composite index

Source: S&P Indices

Source: S&P Indices

However, the weightage for Defensive sectors is low at 17.6% in the S&P GCC Composite with Communication Services (9.6%), Consumer Staples(3%), Consumer Discretionary(2.3%), Utilities (1.7%) and Healthcare(1%). The Covid-19 crisis and outperformance of these sectors could result in these sectors getting a higher weightage which can further result in further out-performance in the future. This could also encourage un-listed companies in these sectors to consider IPOs as they observe their listed peers outperform the market. The market too needs an adequate number of defensive stocks as they can offer support during downturns and prevent investors,particularly institutional investors from leaving the markets entirely.

Ad: Marmore Research Report

Stay Tuned To Marmore MENA Insights!

Never miss a patch or an update with Marmore's Newsletter. Subscribe now!

Related Article

The uptick in MENA Eurobond issuances – A sign of things to come?

MENA debt issuances have touched record highs in Q1 2025. Will the uptick continue in subsequent quarters?

Read MoreKuwait’s Approval of Public Debt Law: Re-emerging on Investors’ Radar

Kuwait has passed the long-awaited debt law in March 2025. The blog explores the importance of the law, the expected benefits and outlook for the countrys return to debt markets.

Read MoreThe Dynamic Rise of Fintech in the GCC

The convergence of technology and finance is reshaping the GCC Financial Ecosystem. The blog explores key players, regulatory framework and market dynamics of Fintech in the GCC region.

Read More