According to our recently released Monthly Market Review for the month of July, the second half of the year started on a good note for the stock markets of Kuwait and its regional peers, as they continue to yield positive results. Kuwait markets registered a positive performance for the month of July, as its All Share index gained 5.7%, propelling its YTD gains to 9.6%. Among Kuwait’s blue chip companies, Zain, Kuwait Financial House (KFH) and National Bank of Kuwait (NBK) were the best performers, gaining 11.7%, 8.2% and 8.0% respectively in July. The positive investor sentiment prevailing over banking stocks, on the back of promising Q2 2018 results have aided the performance of Kuwait’s leading banks. In addition, the impending merger of KFH with Ahli United Bank has also had a positive impact on the investors after an announcement was made by KFH regarding the appointment of HSBC and Credit Suisse to help arrive at a fair share exchange ratio. The announcement regarding Kuwait’s potential MSCI upgrade at the end of June boosted the country’s blue chips, which posted impressive gains at the start of July and sustained them until the end of the month.

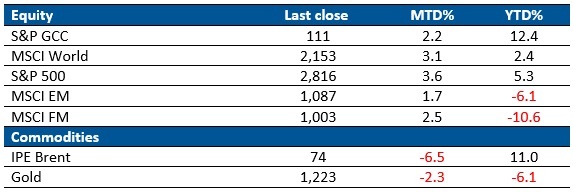

The S&P GCC index was up 2.2% for the month, pushing the YTD returns further to 12.4%. Both MSCI EM and MSCI World were positive for the month, as they gained 1.7% and 3.1% respectively. The performance of S&P GCC index was supported by strong performance of banking stocks across the region. Qatar’s index was the best performer in the region for July with monthly gains of 8.9%, pushing its YTD returns to 15.3%. This was in sharp contrast to the Oman market, which lost 5.1% for the month, extending its losses to 15.0% for the year.

Global Market Trends – July 2018

Source: Reuters

Industries Qatar and Qatar National Bank were the top performers among blue chip companies, rising by 16.4% and 15.1% during the month respectively. With four of Qatar’s top six companies being banks and one of the other two being Industries Qatar, the positivity in macroeconomic conditions such as rise in interest rates and high oil prices have had a major influence on the country’s stock index. Qatar markets were also boosted by the decision of Moody’s to change the country’s sovereign outlook from negative to stable.

MENA Market trends

Major Banks in the GCC region have posted solid earnings for the second quarter of 2018. Profitability of banks and financial institutions in the region have been boosted by rising interest rates, uptick in economic activity and increased government spending.

Meanwhile, Saudi Arabia has been proactive in launching initiatives that help in improving the business environment of the country. Initiatives include the introduction of new draft law to regulate public and private partnerships, in addition to the earlier proposed bankruptcy law, which is expected to come into effect by August. These laws are expected to remove regulatory impediments for doing business in the country and bring in more foreign inflows into the country’s private sector.

Oil Market Review

Oil price witnessed a fall of 6.5% during the month, as the price of Brent crude settled down at USD 74 per barrel, reducing the YTD gains to 11%. Oil price hovered around the USD 80 per barrel mark at the start of the month due to the supply disruptions from Venezuela and Iran. The increased supply from Saudi Arabia and Russia helped ease the demand and bring down oil price to a lower yet healthy level. OPEC released its initial forecast for oil supply and demand in 2019 during the month. According to the forecast, demand for oil is expected to breach the 100 million bpd threshold for the first time.

Stay Tuned To Marmore MENA Insights!

Never miss a patch or an update with Marmore's Newsletter. Subscribe now!

Related Article

The uptick in MENA Eurobond issuances – A sign of things to come?

MENA debt issuances have touched record highs in Q1 2025. Will the uptick continue in subsequent quarters?

Read MoreKuwait’s Approval of Public Debt Law: Re-emerging on Investors’ Radar

Kuwait has passed the long-awaited debt law in March 2025. The blog explores the importance of the law, the expected benefits and outlook for the countrys return to debt markets.

Read MoreThe Dynamic Rise of Fintech in the GCC

The convergence of technology and finance is reshaping the GCC Financial Ecosystem. The blog explores key players, regulatory framework and market dynamics of Fintech in the GCC region.

Read More