Establishing GCC Yield Curve – More Important now than ever!

Marmore Team

06 June 2018

A number of GCC corporates have been active in the debt markets, especially in the recent past, as the bank lending had been constrained while the financial environment offered money at attractive lower interest rates. Considering the surge in issuances and the need for development of domestic debt market many have been advocating for the need to establish a domestic sovereign yield curve that shall help the GCC companies to raise funds at a cheaper rate.

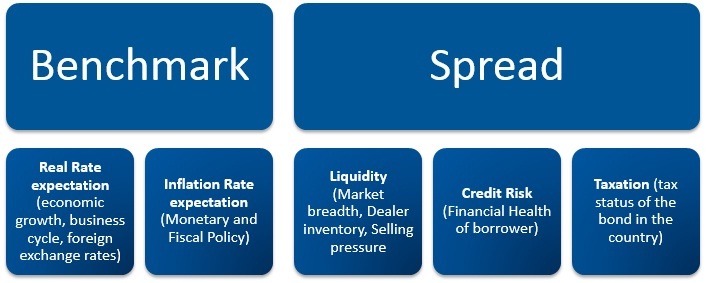

Presence of sovereign yields or availability of rates across maturities would serve as a useful reference point for pricing private domestic debt issues. The yield-to-maturity of a bond is the total return that a bond earns if it is held-to-maturity and all coupons, are reinvested at the same rate (i.e. yield). It is the implied market discount rate. It majorly comprises of two components, the ‘benchmark’ and the ‘spread’. In the absence of any sovereign benchmark, the businesses are forced to borrow debt at a high premium than what their risk may warrant. When a company issues a bond in the absence of a sovereign yield curve, evaluation of such an issue is perplexing. In such cases, the benchmark is that of various issues operating in similar industry. Without the presence of a sovereign yield curve the company paper will be an unknown entity.

Constituents of Yield to Maturity

Source: CFA Institute

The ‘benchmark’ captures the macroeconomic factors – those factors that affect all bonds in the market. The spread captures the microeconomic factors specific to the bond issuer and the bond itself. Fixed-rate bonds often use a government benchmark security with the same time-to-maturity as, or the closest time-to-maturity to, the specified bond. The on-the-run (most recently issued) government bond is the most actively traded security and has a coupon rate closest to the current market discount rate for that maturity.

Therefore, the latest sovereign bond issue for a given maturity is referred to as a benchmark issue. It serves to compare bonds that have the same features but issued by another type of issuer.

A yield curve is a line that plots the interest rates, at a set point in time, of bonds having equal credit quality but differing maturity dates. This yield curve serves as a benchmark for other debt in the domestic market, such as mortgage rates or bank lending rates, and helps to predict changes in economic output and growth. The higher interest rate normally commanded by treasury bonds reflects risk premium.

The GCC countries have been heavily reliant on oil revenues in order to finance their expenditures. This reliance was tested in the summer of 2014 when the oil prices plummeted to a record low. Consequently, GDP growth stalled and the fiscal surpluses vanished amid the need to increase investments in a plethora of projects – infrastructure, health, education, and defence – to ensure long-term growth and diversification.

The liquidity crunch in the region made traditional loan financing difficult for most corporates. While the governments realised that the historical approach to use their abundant forex reserves to cover the budgetary shortfalls would be unsustainable. These forex reserves serve an important purpose to maintain the currency peg, thereby ensuring macroeconomic stability in the region.

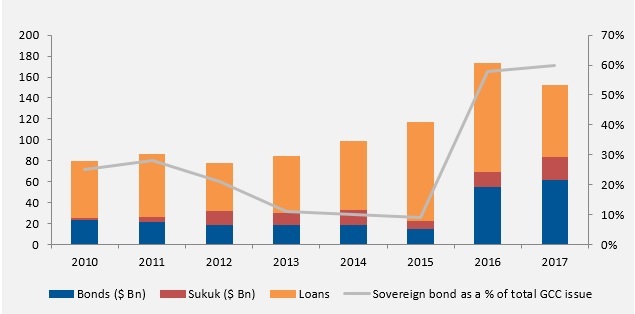

As a result, the appetite for GCC bonds soared in 2016. The quantitative easing measures in Europe and elsewhere meant the excess liquidity was seeking to be parked in safe haven assets. Investors started perceiving the sovereign issues from the stable GCC countries as a safe bet, given the low leverage ratios, substantial forex reserves and various reform programs to ensure steady and diverse financing. Moreover, there has been a strong revival in credit markets on a year-to-date basis so far, which augurs well for the debt issuance from the GCC countries.

Debt boomed in 2016, majority being sovereign issues

Source: Bloomberg

GCC countries are expected to continue raising funds through bond issuance in the near future. It could result in issuances of new securities at various maturities, which could help in the establishment of sovereign yield curve in the GCC. The construction of benchmark curve is especially important for corporate borrowing as they are expected to be the primary source of fund raising going forward. The government borrowing could decrease going ahead due to rising oil prices, giving way for private sector borrowing. The corporate players would be smart enough to take lesson from the past and not rely just on bank loan as a source of borrowing.

The nature of issuance of sovereign bonds however has been disparate among the countries. While none of the countries currently have an active 30-year domestic bond, Kuwait in particular is constrained by its legislations that prohibits issuance of bonds with a tenure of more than 10 years.

Table: Presence of domestic sovereign issues (active) by maturity

Source: Reuters; Note: None of the GCC countries has 30yr domestic issue.

Despite the improving state of economy (and liquidity), Kuwait government should be an active player in the domestic debt markets and issue notes of varied tenures. The advantages are multi-fold. Positive economic outlook on the account of the rising oil prices and a bullish global investor perspective toward the GCC markets mean issuances could be made at somewhat low, stable yields. This would relieve some pressure on the loan markets, which has been the traditional source of financing until date.

Varied issuances at the sovereign level would help in development of a yield curve, which in turn will help in better pricing of private issues. The systemization of yield data would put a downward pressure on the cost of capital due to increased transparency. It would also be beneficial for the corporate houses based in the country to issue additional domestic debt to finance their operations and explore growth opportunities. Lack of benchmark (hence transparency) would result in increased cost of capital. The absence of sovereign yield curve is one of the leading factors that is holding back bond issuance from corporates in the region. As the GCC countries take a step towards establishing a yield curve, we might witness sharp surge in domestic corporate issuance subsequently.

Stay Tuned To Marmore MENA Insights!

Never miss a patch or an update with Marmore's Newsletter. Subscribe now!

Related Article

The uptick in MENA Eurobond issuances – A sign of things to come?

MENA debt issuances have touched record highs in Q1 2025. Will the uptick continue in subsequent quarters?

Read MoreKuwait’s Approval of Public Debt Law: Re-emerging on Investors’ Radar

Kuwait has passed the long-awaited debt law in March 2025. The blog explores the importance of the law, the expected benefits and outlook for the countrys return to debt markets.

Read MoreThe Dynamic Rise of Fintech in the GCC

The convergence of technology and finance is reshaping the GCC Financial Ecosystem. The blog explores key players, regulatory framework and market dynamics of Fintech in the GCC region.

Read More