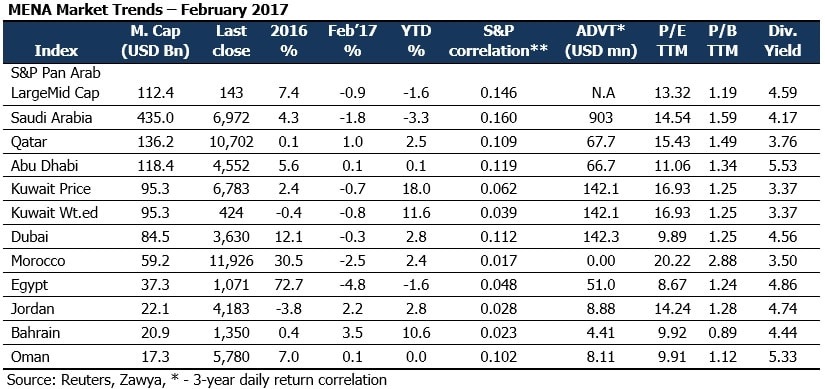

According to Marmore’s recently released Monthly Market Review, most MENA bourses rebounded from a positive start to 2017, to close the month of February in the red. Bahrain, Jordan and Qatar were the exceptions, with the respective indices closing the month at 3.5%, 2.2% and 1%. Egypt, Morocco and Saudi Arabia were the laggards in February, falling by 4.8%, 2.5% and 1.8%, respectively. Kuwaiti Price and Weighted indices also fell by 0.7% and 0.8%, respectively. Profit taking dragged stock markets down in the region, at the month’s close, after quarterly earnings failed to inspire investors. Shares in Egypt slumped after speculation that the finance ministry would recommend a 0.2% stamp duty on stock transactions for both sellers and buyers. Some analysts attributed the sell-off more to the strengthening of the Egyptian pound, which has spurred foreign investors to take profits. An uninspiring global market environment and no fresh news to stimulate trading, most MENA bourses slumped to post loses. S&P GCC close the month at 100 points, down 0.8% from the previous month.

Value traded and volumes in February reflected the market mood, with volumes and value traded dropping 38% and 26%, respectively. All MENA markets, barring Jordan, Oman and Qatar, witnessed a fall in market liquidity in February, while Oman was the sole exchange to post positive increase in volumes. Value traded in Kuwait continued to rise, and stood at USD 6.7bn for 2016-YTD, compared to USD 9.5bn for the whole of 2016. In terms of valuation, P/E of Morocco (20.2x), Kuwait (16.9x), and Qatar (15.4x) markets were the premium markets in the MENA region, while the markets of Egypt (8.7x), Dubai (9.9x), and Bahrain (9.9x) were the discount markets.

Blue Chips had a mixed month, with most companies posting a gain. Shares of DP World (UAE), Saudi Electric and First Gulf Bank (UAE) posted the largest gains for February, at 12%, 8.4%, and 5.4%, respectively. Kuwait Projects (-10.7%) and National Commercial Bank (Saudi, -5.6%) lagged behind the rest. DP World witnessed rise in annual volume growth, as the company handled 3.2% more containers YoY in 2016, helped by higher volumes in Europe and Asia, but its home terminal processed less cargo amid challenging global market conditions. The company also signed a five-year extended agreement with leading strategic procurement company Tejari following a “highly successful” partnership. Commercial Bank of Dubai recorded a net profit of AED 1bn for the year 2016, 5.9% lower compared to AED 1.07bn for the last year mainly due to prudent provisioning. Dubai-based telecom operator du reported a 9.79% decrease in 2016 profit, despite a 3.16% increase in revenues, due to 10% increase in royalty fee, making this the ninth consecutive quarter the company has reported declining profits. Logistics conglomerate Agility tumbled 6.7% after saying it was seeking to settle by arbitration a USD 380m dispute with Iraq’s government over its investment in the Iraqi telecommunications industry.

Saudi Secondary Equity Market

Saudi Arabia launched a secondary equity market, for smaller and family-run firms, which aims to improve companies’ access to capital and expose them to market disciplines in an economy dominated by small and mid-sized enterprises, most of which are family-owned.

All seven stocks listed on Saudi Arabia’s new Nomu parallel equity market surged during their first day of trading on 26th Feb 2017, as investors flocked to put their money in the exchange. Al Omran Industrial Trading, Development Works Food, Raydan Cuisines and Restaurants, Abdullah Saad Mohammed Abo Moati for Bookstores and Arab Sea Information System all surged 20 per cent – the maximum daily allowed amount – from their IPO prices.

The new index forms part of the kingdom’s economic development programme, and is designed to reduce pressure on banks by providing alternative sources of capital for smaller businesses, while at the same time offering lighter listing requirements than the main Tadawul stock exchange. The new market also allows companies listed on Nomu to move up to the Tadawul, after trading for at least two years.

Oil Market Review

Brent crude fell by 0.2 per cent to close the month at USD 55.6 per barrel, having maintained the price level at above USD 50 per barrel since the beginning of the year. Oil prices continued to slip as rising US supplies offset OPEC cuts, which have been surprisingly compliant with the agreed output curbs, and could improve in coming months as the laggards, UAE and Iraq, catch up with their targeted declines.

Stay Tuned To Marmore MENA Insights!

Never miss a patch or an update with Marmore's Newsletter. Subscribe now!

Related Article

The uptick in MENA Eurobond issuances – A sign of things to come?

MENA debt issuances have touched record highs in Q1 2025. Will the uptick continue in subsequent quarters?

Read MoreKuwait’s Approval of Public Debt Law: Re-emerging on Investors’ Radar

Kuwait has passed the long-awaited debt law in March 2025. The blog explores the importance of the law, the expected benefits and outlook for the countrys return to debt markets.

Read MoreThe Dynamic Rise of Fintech in the GCC

The convergence of technology and finance is reshaping the GCC Financial Ecosystem. The blog explores key players, regulatory framework and market dynamics of Fintech in the GCC region.

Read More