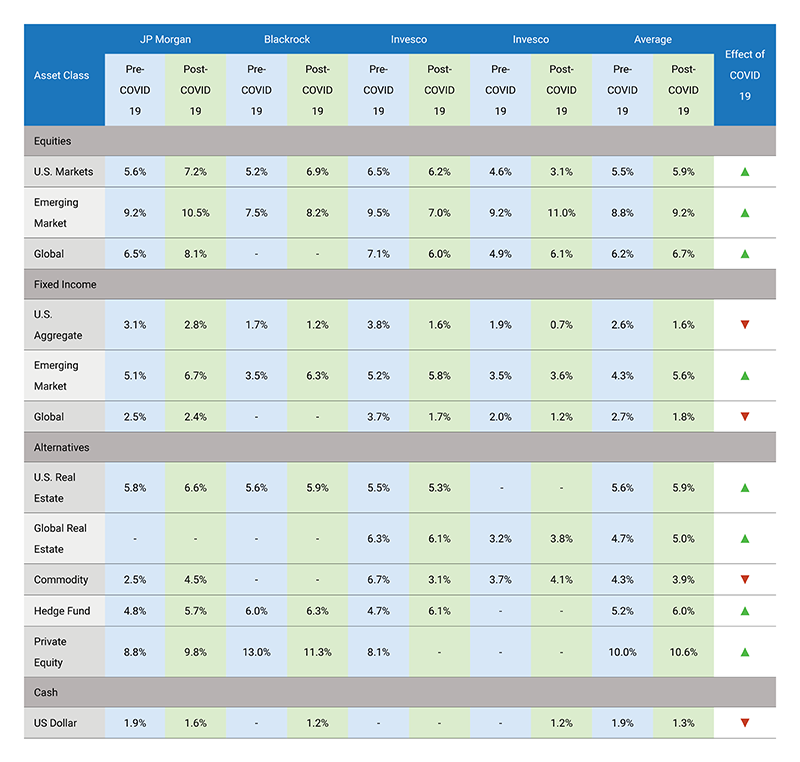

The unprecedented turn of events in recent times has drastically changed the outlook of the global economy in the near term. The economic disruption caused by COVID-19 has triggered global central banks and governments to act, changing the whole landscape for financial and real assets both in the short and long term. Things look much different now as compared to the end of 2019. Several asset classes witnessed a sharp sell-off and a subsequent recovery in recent months. Everything from valuations, macroeconomic indicators and risk appetite have changed within a short span of time. While the impact of COVID-19 is expected to wane away in the next few years, the global fund houses have revised their long-term capital market expectations for 2020 in light of the new reality.

The views of global fund houses slightly differ, the commonalities suggest that there is much more optimism in selected equity and private assets compared to fixed income due to the current low rate scenario. J.P. Morgan does not expect the current recession to significantly affect the growth in the long run as most of the current losses have been taken on to the government’s balance sheets. Household spending and corporate financial health is not expected to suffer a major deterioration in the long run, therefore their change in forecasts are much more reliant on valuations and current prices. Blackrock believes that the near-term impact (a three-quarter timeframe) of COVID-19 on economic activity to be much severe compared to the global financial crisis. However, with appropriate policy response and execution, the impact over the long term could be much less extreme compared to the global financial crisis. Invesco considers a U-shaped recession as their Base case but is less optimistic about long term returns for most asset classes as compared to pre-COVID-19 expectations.

Changes in 10 Year return expectations of Global fund houses

Source: Respective company websites/reports

Equities

Expected returns of equity markets have largely risen due to the drop in price levels during recent months. However, the revisions have only been mild due to expected deterioration in earnings over the next few years. The reversion of earnings growth back to pre-COVID 19 levels is expected to be gradual. Based on prior recessions, earnings growth is likely to contract in the first year before recovering in the third year and eventually reverting to its long-term average growth rate by the fifth year. U.S. equities have remained expensive compared to other developed markets. Yet they are expected to continue setting the pace for global equity markets due to their strong fundamentals and bias towards technology stocks. Major fund houses J.P. Morgan and Blackrock expect valuations to return to their peak once normalcy resumes. The recent fall in index levels have prompted both fund house to sharply increase their expected returns in U.S equities for the next 10 years. Invesco, whose long-term return expectations for U.S. equities were higher than other major fund houses before COVID-19 outbreak, has reduced their expected returns mildly, but continue to favour U.S. markets over others. Among emerging and other developed markets, the economies that are more self sufficient and isolated to others are expected to perform better than those that heavily rely on external demand. Emerging market return expectations have been revised upwards by most fund houses, while their risk also remains significantly high. The fall in valuations and the relative underperformance of emerging markets in the past five years have led to higher expectations for the next 10 years.

Fixed income

The strength of government and corporate balance sheets, recovery of economic growth and future demand will be key determinants of fixed income performance in the coming years. Government bond returns have fallen and in most cases are now negative in real terms. Although duration is set to remain in demand while the world is in recession, fund houses are not very optimistic on developed market bonds in the long term. The likelihood of corporate defaults in expected to be above average for the next 3-4 years. Furthermore, Blackrock believes that the case for nominal developed market government bonds has diminished. Inflation-linked bonds may become the preferable risk absorbing asset, if de-globalization and supply chain changes pick up pace, governments ramp up support and inflation begins to emerge.

Alternatives

Hedge funds remain attractive on a risk-adjusted basis due to their ability to provide alpha beyond their exposure to traditional asset classes. Likewise, the outlook of private equity remained high due to their ability in terms of alpha generation in the medium to long term. Dry powder of private equity funds can be deployed at much lower entry multiples now due to the fall in valuation of businesses. Major fund houses have revised the expectations for real estate upwards but remain cautious. Despite a strong rally in Gold during recent months, the return expectations are largely unchanged. The weaker dollar and an eventual rebound in inflation to support returns for gold in the long run. Weakening of demand for oil and other commodities has led global fund houses to tone down their expectations for a basket of commodities.

GCC markets have been grabbing the attention of global investors in recent times due recent capital market reforms and possessing a stable economy backed by sizeable reserves. However, the coverage on long term return expectations on GCC markets in the public domain has been scarce. To provide clarity to investors on GCC countries and bridge the gap in information, Marmore has published reports on 5-year equity market return expectations for individual GCC countries, clearly outlining their future prospects, assumptions, and growth potential.

To know more, download our latest reports on equity market expectations

Saudi Arabia – Equity Market Return Expectations for KSA, 2020 – 2024

Abu Dhabi – Equity Market Return Expectations for Abu Dhabi, 2020 – 2024

Dubai – Equity Market Return Expectations for Dubai, 2020 – 2024

Qatar – Equity Market Return Expectations for Qatar, 2020 – 2024