Saudi Arabia and Bahrain saw outlook upgrades in November. Moody’s has revised Saudi Arabia’s outlook from negative to stable on expectation that country would reverse most of its 2020 debt increase while maintaining fiscal buffers. S&P has revised Bahrain's outlook to stable from negative, citing the fiscal reforms undertaken to strengthen its economy. Higher oil prices and support from other GCC members are also expected to help the country improve its fiscal position. The countries had also issued bonds during the month. Saudi Arabia has sold USD 2bn of Islamic debt maturing in 9 1/2 years and USD 1.25bn of 30-year conventional bonds yielding 3.36%. According to Bloomberg, Saudi government and its sovereign wealth fund are preparing to launch green bonds in the coming months. Bahrain has raised USD 2bn with dual-tranche bond with USD 1bn in 7-1/2-year sukuk at 3.875% and USD 1bn in 12-1/2-year conventional bonds at 5.625%. Gulf Insurance Group has raised KD 60 million in two tranches, one with a fixed coupon of 4.5% and another with a floating coupon of 2.75% over the Central Bank of Kuwait’s discount rate. Warba Bank has mandated Standard Chartered Bank for an offering of fixed periodic distribution amount USD-denominated Regulation S PNC5 Basel III compliant Tier 1 Capital Certificates. It has also invited holders of its outstanding RegS of USD 250mn Perpetual Tier 1 Capital Certificates to tender all of such Existing Capital Certificates for cash.

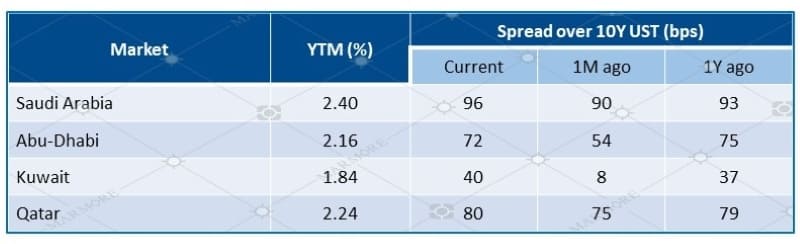

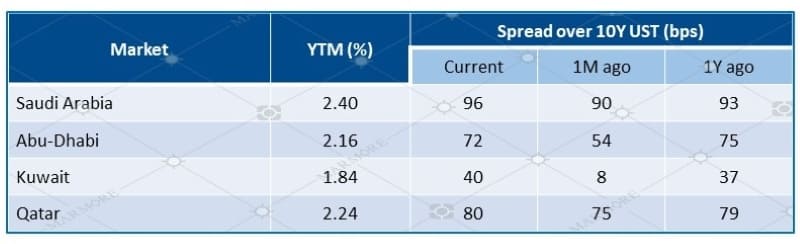

Performance of Key 10-Year Bonds  Source: Refinitiv

Source: Refinitiv

10Y Sovereign Yields  Source: Refinitiv

Source: Refinitiv

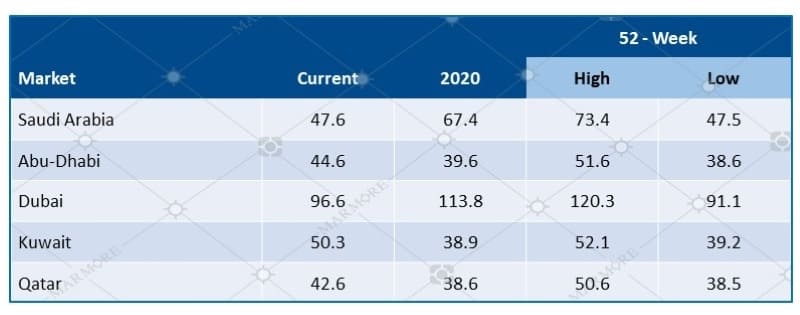

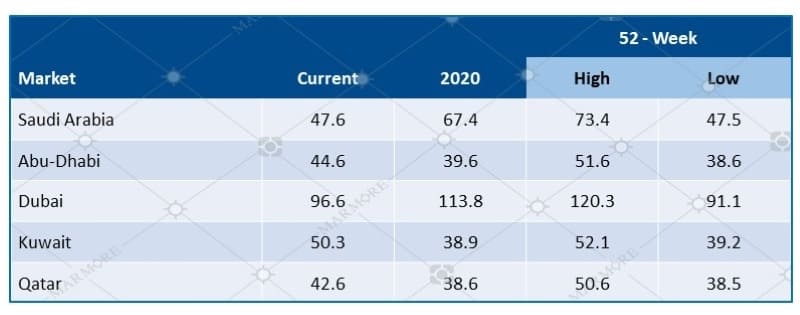

5Y CDS Spreads (bps)  Source: Refinitiv

Source: Refinitiv

Ratings for UAE and Qatar were affirmed by Fitch and S&P respectively. Fitch affirmed UAE at 'AA-’ with stable outlook citing moderate consolidated public debt, strong net external asset position and high GDP per capita. S&P has affirmed Qatar’s ratings at ‘AA-/A-1+’ with stable outlook. While acknowledging that the rapid growth in external funding of Qatar’s banks present balance of payment risk, S&P considers the country’s substantial buffers to be a mitigation factor. Moody's has affirmed ratings of 9 Saudi Banks and has changed their outlook to stable from negative on the back of the banks’ resilient performance. Fitch Ratings has affirmed the credit ratings of First Abu Dhabi Bank, Abu Dhabi Islamic Bank, Dubai Islamic Bank and Mashreq Bank.

Know more about the performance of GCC and Global markets in November in our recent Global & GCC Capital Markets Review. Read more

Source: Refinitiv

Source: Refinitiv Source: Refinitiv

Source: Refinitiv Source: Refinitiv

Source: Refinitiv