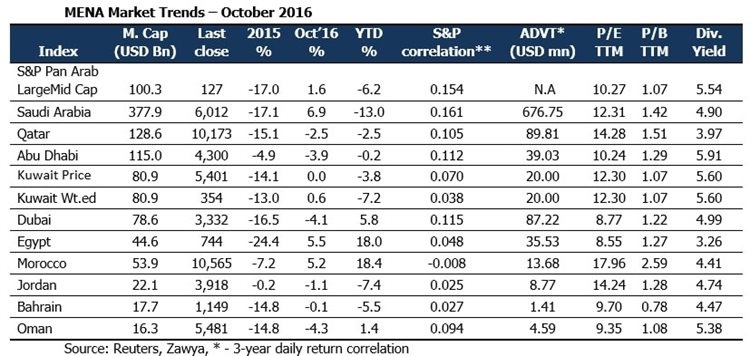

Selling pressure created by Foreign Institutional Investors (FIIs) led to the fall in the Muscat index, while sharp fall seen in the Dubai index was attributed to profit booking, due to volatility in the international commodities and currency market. In terms of valuation, P/E of Morocco (18x), Qatar (14.3x) and Jordan (14.2x) markets were the premium markets in the MENA region, while the markets of Egypt (8.5x), Dubai (8.8x), and Oman (9.3x) were the discount markets.

Blue Chips also had a mixed month, with National Commercial Bank (Saudi Arabia) and Zain (Kuwait) ending the month at the top of the pile, gaining 33.5% and 16.4%, respectively. Kuwait Projects lagged behind the rest of the blue chips, falling by 10%, despite an 8% YoY rise in nine-month net profit. Although third quarter profit fell by 1.6%, shares of NCB were buoyed by the expected easing of liquidity, as the kingdom issued international bonds to tide over rising deficit. The bank cited an 18.7% jump in total operating expenses, caused by higher impairments on financings and investments for the fall in net profit. Zain Kuwait’s number of subscribers increased to 2.9mn for the nine months to 30 September, in a very challenging period that witnessed intense price competition. The company also reported a better than expected 12% rise in third-quarter profit. Qatari telecom operator Ooredoo reported a 51% fall in third-quarter net profit, as the earnings continued to be affected by foreign exchange losses and plunging earnings from Iraq, although a strong domestic performance has helped mitigate the impact. Emaar Properties reported a 31% jump in third-quarter profit, as rising property sales overcame the wider real estate market malaise.

Saudi bond issue and market reforms

Saudi Arabia raised USD 17.5bn in the biggest ever bond sale from an emerging-market nation, as the kingdom sought to shore up finances battered by the slide in oil. The government supposedly sold dollar-denominated bonds due in five years yielding 135 basis points more than similar-maturity US Treasuries, 10-year notes at a spread of 165 basis points and 30-year securities at 210 basis points. The kingdom raised USD 5.5 bon in each of the five- and 10-year bonds, and USD 6.5bn in 30-year debt.

In a bid to improve foreign investment in capital markets and bring the Saudi stock market into the global investing mainstream, the nation’s 175 listed companies are now required by the Capital Markets Authority to adopt the International Financial Reporting Standards (IFRS) from Jan 2017.

Oil Market Review

Brent crude rose to USD 53.14 per barrel in the month of October, before falling 9% and closing the month at USD 48.3 per barrel, as the OPEC deal to reduce crude output faced some obstacles towards the end of the month. OPEC members Iran and Iraq disagreed with the organization’s data on production levels, and have now refused to limit their crude output. Iraq, the second-largest producer in the cartel, is reportedly asking for exemptions from any production limits due to disruptions caused by the insurgency, while other members, including Iran, Libya and Nigeria already have exemptions.