If you want to trade stocks while on the move, look no further than your smartphone for help. Yes, thanks to the advent of mobile trading, you can buy and sell stocks with your smartphone, without being chained to your desktop or your laptop.

Nowadays, many brokerage firms offer mobile share trading service as a significant value addition to the client. Online stock trading removes the middleman and helps you to actively manage your portfolio. This means you have full control by making the stock deals all by yourself!

Mobile trading is just not another mode to do online trading; it offers several additional advantages. You can track share transactions whether you are at home or in the office. You don't have to call anyone to place an order. Instead, you can do everything with a few taps on the phone. Further, there are several Apps that present analysis in the form of charts, statistics, and market news, with which you can take informed decisions. You can do your investments anytime, anywhere with your smartphone.

A little bit of history is in order. Online trading developed slowly: crippled by the stock crash of 1987, plus the recession that followed and the Gulf War. It picked momentum in the 1990s, primarily because of the ease with which it could be operated and the sharp reduction in brokerage fees. Small wonder, the number of online brokerage firms in the US, the mother of equity markets, jumped from 12 in 1994 to 140 by the year 2000. The growth became exponential once mobile phones and tablets arrived. This trend is expected to accelerate everywhere in the future.

Mobile marries Market

The world of capital markets has been expanding, with proliferation in the number of investors and traders. Once a playground for the wealthy, the market is now accessible to the masses, courtesy technological advancement. In this regard, mobile trading is an emerging trend and clearly the rising star.

Mobile phones are no longer meant only to make calls or text. Now they are also used to trade. The statistics speak for themselves. In 2013, 72% of active stock players in the UK used a smartphone or tablet to make equity purchases and sales. Almost 90% of the current traders use a mobile device to monitor their positions. More than seven out of ten close their positions on a smartphone or tablet. Little wonder, brokerage firms are bending backwards to provide clients with top-notch Apps and are pouring money to develop and enhance their mobile capabilities.

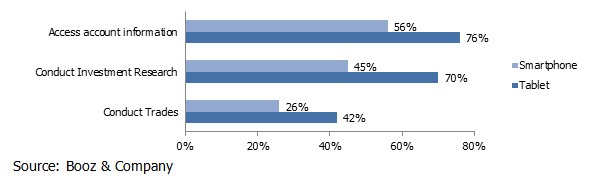

HNIs’ use of Mobile Devices for Financial Management

A study suggested that 42% of the High Net-worth Individuals in the world use tablets and 26% of them use smartphones for conducting to do mobile trading. A larger percentage uses it to access account information and conduct investment research. This is not surprising. After all, with these Apps you can even trade virtual portfolios, draw on stock charts, get real-time streaming price and economic data, and chart FRED [Federal Reserve Economic Data] data series.

There is a reason why mobile trading hasn't caught fire in the GCC region. Users are worried about uncertainty arising from data input errors, software failures, connection loss, and privacy loss. Given increasing reports of mobile Internet hacking, users fear that an unauthorized party will gain access to their financial accounts.

The Mobile has changed the way people communicate and conduct business. In recent years, GCC countries have seen a tremendous rise in the penetration of smartphones. In UAE, for example, smartphone penetration has increased to 74% of the population. 56% of them access the Internet every day on their smartphone and most never leave home without it. Such has been the monumental impact of this gadget in the lives of ordinary people.

Let’s look at some numbers for further proof. In 2013, the number of mobile connections in the GCC was 1.7 times the total population of these countries. That’s almost like one person having two smart phones! This penetration is among the highest in the world, surpassing even developed countries like the USA. Also the number of 3G connections in these countries, which allow usage of high-speed Internet, is on par with developed nations. Table 1 provides the details.

Table 1:

| Country | Connections (Millions) | % 3G | Population (Millions) | Sim Penetration | GNI/capita (USD) |

| UAE | 15.7 | 56% | 9.4 | 167% | 38,620 |

| Saudi Arabia | 51.3 | 58% | 29.1 | 176% | 24,310 |

| Qatar | 3.8 | 52% | 2.2 | 172% | 74,600 |

| Oman | 5.6 | 45% | 3.8 | 149% | 19,450 |

| Bahrain | 2.6 | 44% | 1.3 | 192% | 19,560 |

| Kuwait | 6.4 | 58% | 3.4 | 185% | 44,880 |

| USA | 347.2 | 55% | 321.3 | 108% | 52,340 |

| India | 886.3 | 9% | 1266.1 | 70% | 1,550 |

| Egypt | 99.6 | 23% | 82.7 | 120% | 2,980 |

SIM penetration is based on SIM cards and not on unique subscribers.

Source: GSMA intelligence 2014, UN World Population Prospects 2010, World Bank

Mobile Internet is one of the essential necessities for mobile trading. The amount of Internet usage in all GCC countries through mobile phones is above the global average. Kuwait is the leader in GCC with 27% of its total Internet usage being through mobile phones even as the global average remains at 10%. Table 2 carries Internet Usage in GCC Countries by Platform.

Table 2:

| Kuwait | Oman | Saudi Arabia | Bahrain | UAE | Qatar | Worldwide | |

| % Mobile | 27.02 | 24.3 | 18.51 | 17.43 | 12.75 | 11.49 | 10.01 |

| % Desktop | 72.98 | 75.7 | 81.49 | 82.57 | 87.25 | 88.51 | 89.99 |

Source: StatCounter Global Stats

Advantage Money

Mobile share trading is steadily gaining popularity. More and more brokerage firms are collaborating with the stock market to promote mobile trading.

Dubai Financial Market (DFM) along with licensed brokerage firms provides clients with simple applications to trade shares through their handheld devices.

Emirates NBD Securities, a brokerage company, launched a smartphone application that gives investors access to a wide range of brokerage related services. Investors can place orders, check their portfolio balance, know the market direction and the stock prices, simply by accessing the App on their smartphones.

There are several investment banks and brokerage firms offering mobile trading Apps to attract customers. EFG Hermes, an Investment Bank, has launched a mobile trading application that allows investors in Oman to manage their portfolios over mobile phones. EFG Hermes Securities Brokerage introduced mobile trading to the Omani market. The service is already operational in Egypt and Kuwait. It has plans to introduce this app to other markets as well.

Watani Brokerage launched its NEW NET application in June 2014. This trading platform provides a distinctive electronic trading experience in seven markets, including the GCC and Egypt. Mark it, it allows traders to monitor multiple markets on a single screen with simplified trading and navigation tools. NEW NET has advanced features that allow upgraded options like instant market quote, charts, and direct market access, in addition to the latest news and announcements. Traders can also view their portfolio, orders list, and account summary on a single screen.

The awareness of mobile trading is slowly increasing with use of smartphones. The rapid growth of the major stock markets in the region has also contributed to increase of mobile traders in the region increasing its popularity. Software developers are sweating it out to ensure that the service is fully secure. A password has to be entered to perform every single trade in many cases. Brokerage firms are not far behind, and are launching these apps to show their commitment to customer satisfaction. Clients benefit, as there are no added costs!

Outlook

The signs are very positive for mobile share trading.

Most investors use these Apps for analysis. A lesser percentage trade stocks through mobiles due to security risks. There is the fear that hackers could take away private information, and use it to make unauthorized trades. Incidentally, these threats have been a serious barrier to the adoption of other services like mobile payment systems and mobile ticketing systems. However, companies launching these mobile trading Apps are trying to make them more reliable and secure.

On balance, it is clear that mobile trading offers many benefits including on-the-go trading at any time, from anywhere. Thanks to favorable factors such as the growth of the securities market, demographics and increased level of smartphone penetration mobile trading looks an attractive proposition in the GCC

Stay Tuned To Marmore MENA Insights!

Never miss a patch or an update with Marmore's Newsletter. Subscribe now!

Related Article

The uptick in MENA Eurobond issuances – A sign of things to come?

MENA debt issuances have touched record highs in Q1 2025. Will the uptick continue in subsequent quarters?

Read MoreKuwait’s Approval of Public Debt Law: Re-emerging on Investors’ Radar

Kuwait has passed the long-awaited debt law in March 2025. The blog explores the importance of the law, the expected benefits and outlook for the countrys return to debt markets.

Read MoreThe Dynamic Rise of Fintech in the GCC

The convergence of technology and finance is reshaping the GCC Financial Ecosystem. The blog explores key players, regulatory framework and market dynamics of Fintech in the GCC region.

Read More