COVID-19 has rendered economic outlook and companies’ performance projections for 2020 meaningless in a single stroke. Heightened uncertainty has become an everyday reality in the current times. As the coronavirus scare continues, the world is faced with multidimensional issues and tough questions, be it finding an effective treatment for the virus, zeroing in on an optimal quantum of stimulus or deciding the right time to lift lockdowns. With measures like social distancing and lockdowns affecting day-to-day lives of people, asset classes are feeling the heat too.

Equities

As one of the quickest asset classes to price in developments, equities have seen a huge slump. The spread of virus and associated lockdowns have affected production, supply chains and demand across countries and sectors. Travel restrictions and lockdowns across the world has hurt oil demand. While oil demand for 2020 is expected to drop by 10.8 million barrels per day(bpd), the demand for jet fuel is expected to drop by 2.4 million bpd (Rystad Energy), demand for road fuel is expected to drop by 5.3 million bpd. This demand destruction pushed oil prices to historical lows.

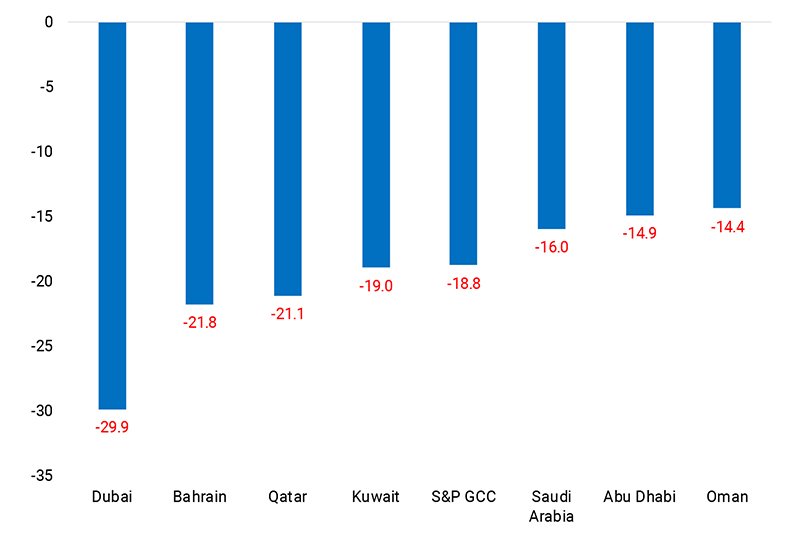

For GCC, these lower oil prices add to the impact of coronavirus. In addition to affecting the oil based sectors, low oil prices would cause government revenues to fall and in turn reduce government spending on non-oil sector. These factors precipitated fears about economic growth in general and corporate earnings in particular, pushing stock prices down. Of the GCC countries, Dubai is most at risk with 32% of its GDP coming from sectors affected by social distancing (MUFG). This has reflected in its equity performance too.

Year to Date Performance of GCC Markets(%)

Source: Refinitiv; Data as on 12th May 2020.

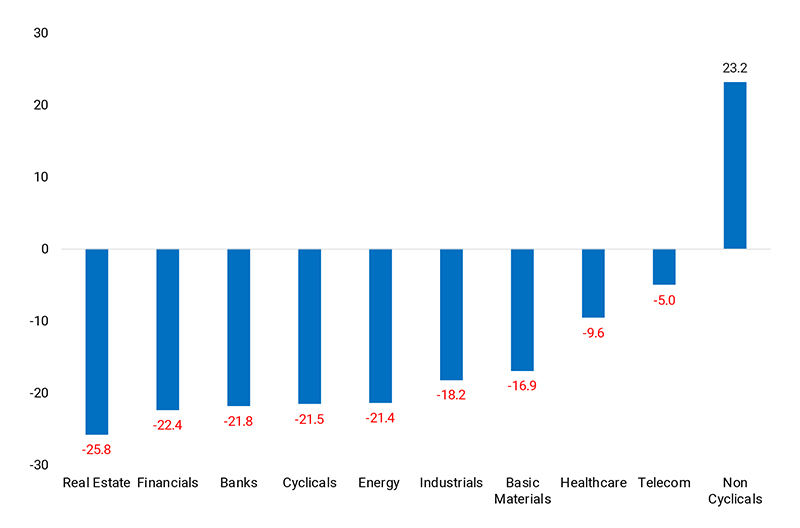

Social distancing and lockdowns have affected almost all sectors, the difference being only in the degree of impact. Travel and Tourism and Energy have taken a direct hit because of the travel restrictions and postponement of events. Possibility of spike in infections as lockdowns ease poses a risk for these sectors. With credit exposure to multiple sectors, banking would be considerably impacted by probable deterioration in asset quality and measures like deferment of loan repayments. Comprising of companies involved in essentials such as food processing, consumer non-cyclicals appears as bright spot amongst other sectors.

Year to Date Performance of GCC Sectors(%)

Source: Refinitiv; Note: Data as of 24th May 2020. Cyclicals includes Hospitality, Tourism; Basic Materials includes Construction; Industrials includes Aviation, Logistics. Non-cyclicals include food processing etc.

Before the virus’ onset, the market valuations in GCC had recovered from 2016 lows (P/E ratio of GCC Price Return Index: 1st January 2020 – 14.4; 2016; 21st January 2016-9.1). The P/E ratio of the GCC price return index fell from a value of 14.4 as of 1st January 2020 to 10.8 in mid-march, on the back of market wide sell-off due to COVID-19. However, the stimulus measures by GCC central banks and governments and plans to ease lockdown have caused an uptick in stock prices and in turn in valuation. While the current P/E ratio at 13.04 (As of 24th May 2020) , remains slightly lower than value at the beginning of the year, it is based on the healthier corporate earnings of the last 12 months. As the impact of COVID-19 on underlying corporate earnings picture continues to remain grim and uncertain, it remains to be seen if the valuations could sustain at current levels.

Concerns of limited policy space to cushion COVID-19 impact and economic slowdown increase foreign capital outflows, contributing to the fall in equity markets. For example, in March 2020, foreign equity outflows from Saudi Arabia amounted to USD 722 million (Preliminary Data from IIF).

Bonds and Sukuk

While preference for bonds over equities in uncertain times and interest rate cuts by central banks of countries are support factors for bonds in general, credit strength and perception of risk associated with each borrower would determine demand for their bonds.

For example, considered as a strong borrower, the U.S 10-year Treasury yield has dropped from 1.88% on 1st January 2020 to 0.69% on 12th May 2020. In GCC, the oil price crash has increased the perception of the region’s credit risk. This had reflected in the widening of 5-year CDS spreads and fall in prices of sovereign bonds in mid-March.

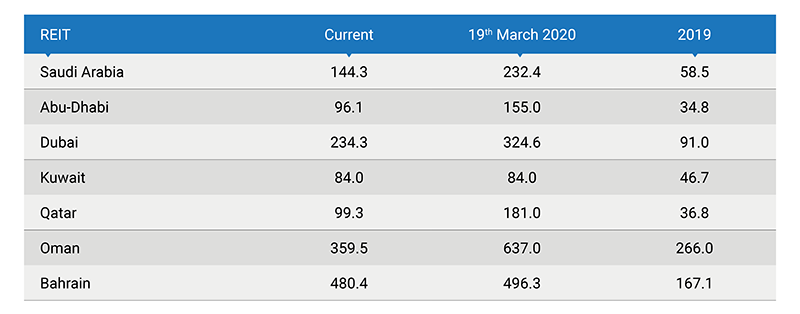

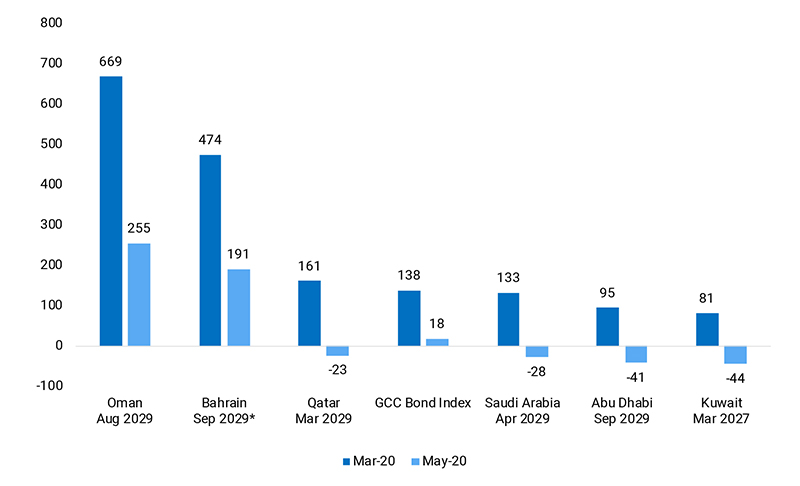

5-year CDS Spreads (in bps)

Source: Refinitiv; Note: Bahrain’s CDS reached a high of 508 in the first week of May.

The bond yields for GCC countries have narrowed recently, supported by improvement in oil prices and introduction of austerity measures. For Bahrain and Oman, yields remain above 2019 levels because of concerns over their weak fiscal positions. Further yield movements would hinge on recovery in oil prices and governments’ implementation of austerity measures. A favourable outcome on these factors would improve the GCC countries’ fiscal position and credit strength.

YTD Change in Yields of 10-year Sovereign Bond and the S&P GCC Bond Index for Corporates (in bps)

Source: Refinitiv; S&P; Note: Bahrain – 12-year bond; Dates: 19th March 2020; 24th May 2020

As revenue declines on the back of fall in oil prices, debt maturities add to financial concerns. For example, by the end of 2020, Dubai and its government-linked firms face USD 9.2 billion of debt repayment . The table below showcases the upcoming bond repayments for Saudi Arabia and UAE.

Bond Redemption (All Currency) in 2020-22 (USD Billion)

Source: IIF

Low oil prices and stimulus measures to handle COVID-19 have brought GCC governments’ fiscal position under pressure, necessitating borrowing. This might increase sovereign issuances.

Investment grade corporate bonds yields have widened by a smaller margin than sovereigns like Bahrain, which have lower credit rating compared to their peers. While investment grade corporate bonds might continue to be viewed favourably, fear of defaults might drive investor exit from high-yield bonds. For example, while the S&P GCC Sukuk Index yield has narrowed by 24 bps, S&P GCC High Yield Sukuk Index’s yield has widened by 198 bps (As on 21st May 2020).

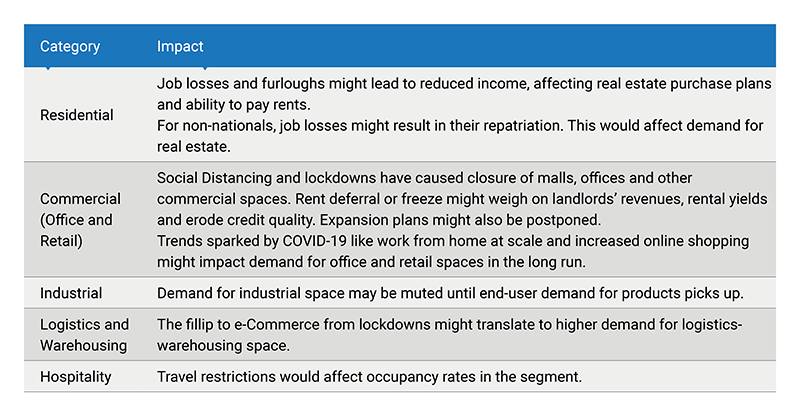

Real Estate

The spread of the virus, lockdowns and job losses might lead to decreased demand for real estate sector in the near term. In countries like UAE, where oversupply had been a concern before the virus outbreak, the impact might be compounded.

Covid-19 Implications on Real Estate Asset Class

Source: Marmore Research

Given the magnitude of the global humanitarian challenge and the end for pandemic nowhere in sight, the asset classes might take time to recover. The actual bottoming out of the pandemic or an effective vaccine would provide the much needed optimism and boost for the markets. However, the recent relaxation of lockdowns with governments calling for learning to live with COVID-19 by implementing safety measures might be favourable in the near term. When the crisis does bottom out, government measures and credit conditions would support recovery.