When US stock market sneezes, Emerging markets including India catches cold! However, this time around there is positive news for Indian tech startups in the form of Special Purpose Acquisition Companies (SPAC’s). Though SPAC’s are not a new concept, suddenly they seem to be in a rage in US for a variety of reasons. Before that, let us briefly look at what this is.

As the name implies, it is a special purpose vehicle formed and floated in the market with no underlying business to start with. Sponsors (the idea initiators basically) form and list this SPAC by raising funds from investors with the objective of finding a target company which typically happens to be a private company mostly in the tech space. Since the underlying SPAC does not start with any business operations, it is also naughtily referred to as “blank-cheque” companies. So long as the target is yet to be identified, it continues to be a blank cheque company. Since it has no underlying operations or valuations, it is priced at $10 and may trade with a small premium or discount around this value till the sponsors disclose the target details. However, if market participants sniff rumors about the target companies, then the share price may start appreciating rapidly during which time it attracts retail investors. If the subsequent disclosure about the target proves to be true, then everyone including the retail investors walk to the bank laughing. Else, better luck next time!

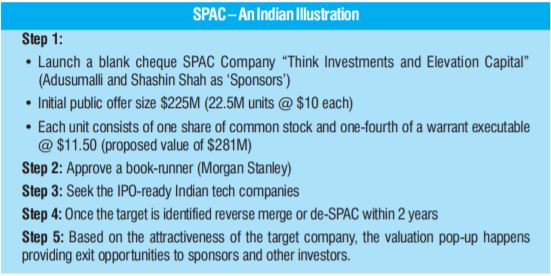

While this is a US phenomenon, it has also started attracting Indian investors. I tried explaining the workings of a SPAC through a live illustration.

India has the third largest startup ecosystem in the world with over 40,000 startups and 38 unicorns (companies valued at a billion dollar or more). While the number of unicorns are not that high when benchmarked globally, the arrival of SPAC promises some good news for many tech startups to aspire the unicorn status.

The reason why SPAC’s have become overnight sensation is due to the onerous regulations surrounding the typical IPO process. Companies aspiring to go through the traditional IPO route has to fulfill profitability, financial and business disclosure requirements that can be considered stringent. This results in invasive due diligence along with high cost of listing. Due to this, the average time a startup stays private has increased from 4 years to 11 years, which can be a huge negative for initial investors (mostly venture capitalists and private equity firms) who desire for early profitable exits.

The untypical SPAC provides an easy and quick solution to all the travails of typical IPO and hence this new found enthusiasm for SPAC’s. The SPAC structure is highly investor friendly where investors can opt to receive their money back at the time when the deal is announced. This unique structure ensures faster IPO option for private companies with low-risk investments for investors with equity upside. In addition, the SPAC structure provides for better price discovery as compared to IPO route where price is usually determined through book-building process where investors can know the price only towards the end of the IPO calendar. No wonder, the US market has witnessed a deluge of SPAC’s, with more than 240 SPAC’s raising nearly $72 billion dollars yielding an average SPAC fund raising of approximately $320 million. It is estimated that around four SPAC’s are being formed on a daily basis. When sponsors float a SPAC and raise funds, it provides them with the dry powder necessary to identify and consummate targets.

Facing Flak

However, there are valid criticisms surrounding this sudden hype. Firstly, the 2-year deadline to identify and reverse merge a target can be a serious pain point for sponsors. As the clock ticks away, the bargaining power of sponsors dwindles leading to sub-par valuation outcomes. Secondly, in this race to find a decent target within two years, sponsors may land up with bad deals leading to negative outcomes for everyone including the sponsors leading to significant dilution. Thirdly, the mushrooming of SPAC’s can increase competition for good companies to take public. Fourthly, since SPAC’s are dominated by retail investors, their behavior for approving the demerger process through voting can prove onerous. In a typical IPO scenario, existing investors tend to be promoters and institutional investors who are easy to deal with when it comes to voting approvals. However, coordinating the same with thousands of retail investors is certainly not a walk in the park. It is said that many retail investors that buy SPAC’s from the open market are not even aware of the voting requirements.

Yet It’s advantage “SPAC”!

For now, the pros outweigh the cons for Indian tech startups who can aspire for faster outcomes through SPAC’s. From a regulatory point of view, the structure of Indian SPAC’s can attract a variety of legislations including but not limited to corporate law, FDI regulations, FEMA and Liberalized Remittance Scheme (LRS). Hence, this may involve extensive legal consultations. In summary, SPAC’s provide a nice additional route to monetize valuation for Indian tech startups and hence it will be interesting to watch this space.

Stay Tuned To Marmore MENA Insights!

Never miss a patch or an update with Marmore's Newsletter. Subscribe now!

Related Article

The uptick in MENA Eurobond issuances – A sign of things to come?

MENA debt issuances have touched record highs in Q1 2025. Will the uptick continue in subsequent quarters?

Read MoreKuwait’s Approval of Public Debt Law: Re-emerging on Investors’ Radar

Kuwait has passed the long-awaited debt law in March 2025. The blog explores the importance of the law, the expected benefits and outlook for the countrys return to debt markets.

Read MoreThe Dynamic Rise of Fintech in the GCC

The convergence of technology and finance is reshaping the GCC Financial Ecosystem. The blog explores key players, regulatory framework and market dynamics of Fintech in the GCC region.

Read More