This article was first published in Islamic Finance news dated December 2019.

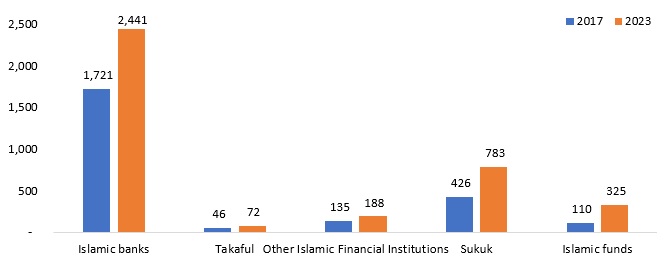

Globally, the assets under Islamic finance industry have surpassed the USD 2.4tn mark. Digitalization which has emerged as a revolutionary trend in financial system is becoming popular in Islamic finance industry as well. Islamic banks account for over 70% of industry’s total assets, as of latest available. Islamic liquidity management instruments are still at their infancy, and there are very few instruments that meets the industry needs and investors’ expectations at the same time.

Breakup of assets under Islamic finance industry (USD bn)

Source: Reuters

The main challenge in Islamic finance industry lies in the process of providing liquidity management tools that can compete with conventional ones. Unlike conventional institutions, the dearth of liquidity in Islamic finance industry due to lack of tradeable instruments as Shariah restrictions limits the range of instruments that can be used for liquidity management. Islamic interbank and money markets also lack the magnitude of volume and diversification as seen in conventional markets.

However, over the years there has been improvement in liquidity in secondary market trading helped by global Islamic players such as HSBC Amanah, CIMB Islamic (Malaysia) and Dubai Islamic Bank that have been actively involved in the trading of sukuk papers in the secondary market. Dubai and Malaysian market are among the most popular stock markets that have seen high growth in liquidity. It is important to note that in Nov-2006, Dubai stock exchange announced its restructuring plans to become the world’s first Islamic bourse.

A variety of approaches have been adopted in different jurisdictions and much work has been done to diversify the mix of available options for Islamic banks to manage their short to medium-term liquidity. Organizations providing Shariah standards such as Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) and the Islamic Financial Services Board (IFSB) established in 1991 and 2002 respectively are playing an important role in bridging this gap.

More strategies that suits the liquidity management and personal financing needs of Islamic finance industry continue to be developed. One such product is National Bonds’ Sukuk Trading Platform that simultaneously addresses the operational requirements of Islamic banks and their customers and external stakeholders’ preferences. In liquidity management, it has the potential to be both flexible and authentic, offering an investment destination to park the surplus funds or an investment tool/model which financial institutions and central banks can utilize for providing liquidity to banks when needed.

Islamic banks will continue to shift towards Islamic liquidity management instruments that increase their ability to place more of their surplus liquidity with other banks or with the central bank. Liquidity management however continues to remain at the core of the issues that regulators need to address to ensure the healthy growth and development of the Islamic banking sector.

Since the financial crisis, new regulatory requirements under Basel III have increased requirement by banks to hold sufficient high-quality liquid assets. To overcome liquidity management issues, the International Islamic Liquidity Management Corporation (IILM) was established in 2010. Following its establishment, it marked another milestone with the issuance of US Dollar denominated rated tradable Sukuk in Aug-2013. These instruments have contributed in enhancing the cross-border flows, strengthening the international linkages and promoting financial stability.

In Feb-2009, Indonesia became the first nation to sell retail sharia-compliant bonds targeting retail investors. Since then Malaysia and Pakistan have also issued retail focused sukuk and most recently Saudi Arabia is also looking to open up Islamic bond market to retail investors. The appeal of sharia-compliant financial products has since broadened with the creation of a more active investor base and increasing number of organizations considering sukuk market as an alternative for raising funds.

More recently, there has been a spur in the launch of digital only Islamic banks. Several governments with large Islamic financial systems including UAE and Bahrain are encouraging Fintech through creation of regulatory sandboxes. Shariah scholars are also evaluating the extent of Shariah compliance of latest innovations such as cryptocurrencies and actively helping Fintech firms to develop Shariah compliant products.

According to Reuters estimates, Islamic finance industry that currently comprise of nearly 1,400 institutions globally, has a potential to reach close to USD 3.8tn by 2023. Adoption of latest technology will play a significant role in this regard.

Stay Tuned To Marmore MENA Insights!

Never miss a patch or an update with Marmore's Newsletter. Subscribe now!

Related Article

The uptick in MENA Eurobond issuances – A sign of things to come?

MENA debt issuances have touched record highs in Q1 2025. Will the uptick continue in subsequent quarters?

Read MoreKuwait’s Approval of Public Debt Law: Re-emerging on Investors’ Radar

Kuwait has passed the long-awaited debt law in March 2025. The blog explores the importance of the law, the expected benefits and outlook for the countrys return to debt markets.

Read MoreThe Dynamic Rise of Fintech in the GCC

The convergence of technology and finance is reshaping the GCC Financial Ecosystem. The blog explores key players, regulatory framework and market dynamics of Fintech in the GCC region.

Read More