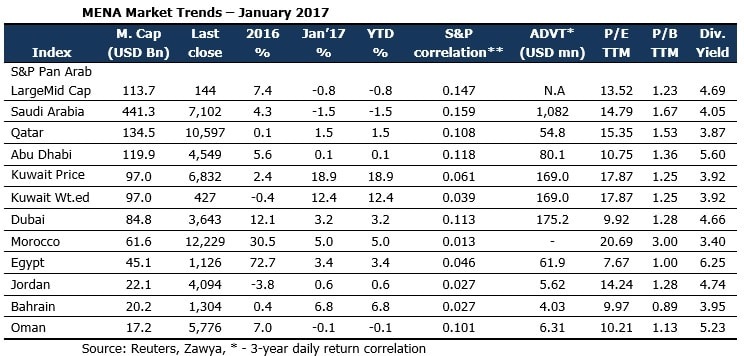

According to Marmore’s recently released Monthly Market Review, MENA bourses had a positive start to the year 2017, with nearly all markets ending the first month in green. Kuwaiti Price and Weighted indices led the charge, rising by 18.9% and 12.4%, respectively, followed by Bahrain (6.8%). Saudi Arabia and Oman were the only markets to register a fall in January, falling by 1.5% and 0.1%, respectively. Various reasons are being touted for the 14-day consecutive rally in the Kuwait bourses, but a look at the top five stocks by value traded suggest that main activities are largely in large cap companies. The appointment of the new chairman and a series of market reforms may have led to investors hoping that steps might be taken to boost foreign inflows, following the regional peers UAE, Qatar and Saudi Arabia. Also, with Pakistan upgraded to MSCI Emerging Markets Index, Kuwait and other countries could see increased representation in the MSCI Frontier Markets Index.

With the fall in oil output, in line with the OPEC agreement, many of the Saudi sectors were affected, with losses posted in Banking, Retail, Hotels & Tourism and Transport sectors. Corporate earnings across all sectors rose by 2% in 2016, but earnings in Banks and Materials companies fell by 5% and 8%, respectively. S&P GCC grew by 1.6% in January, to close the month at 101 points.

MENA markets witnessed an upswing in momentum in January, with volumes rising 53% and value traded 3.7%. All MENA markets, barring Saudi Arabia, witnessed a rise in market liquidity in December, with Kuwait, Bahrain and Abu Dhabi leading the charge. Value traded in Kuwait stood at USD 3.9bn in January, compared to USD 9.5bn for the whole of 2016. In terms of valuation, P/E of Morocco (20.7x), Kuwait (17.9x), and Qatar (15.4x) markets were the premium markets in the MENA region, while the markets of Egypt (7.7x), Dubai (9.9x), and Bahrain (10.0x) were the discount markets.

Blue Chips also had a positive month, with Kuwaiti large caps dominating the best GCC performers in January. Shares of Zain, Kuwait Finance House, National Bank of Kuwait and Kuwait Projects posted double-digit growth, at 20.7%, 14.8%, 12.3% and 12%, respectively. Saudi Telecom (-7.6%) and Emirates Telecom (-4.8%) lagged behind the rest. Kuwait Finance House and National Bank of Kuwait also posted positive growth in 2016 earnings, as revenues grew, while Saudi Telecom witnessed an 8% fall in profits. Q4 profits for SABIC were positive for the first time in ten quarters, which indicated that the worst might be over for Saudi Arabia’s petrochemical sector, since the fall in oil price and government austerity measures raised the cost of gas feedstock. Qatar National Bank has reported a 10% jump year-on-year in net profit to USD 3.4bn for the year ended 2016, helped by stronger core earnings.

New Year Reforms and Bond Issuances

Saudi Stock Exchange is set to introduce settlement of trades within two working days of execution (T+2) during the second quarter of 2017. Tadawul also published draft rules for short-selling, and the borrowing and lending of securities. Presently, trades must be settled on the same day, which has inconvenienced foreign investors in particular, as they must have large amounts of money on hand before trading.

The Saudi cabinet approved an IMF-backed value-added tax (VAT) to be imposed across the Gulf, following the slump in oil prices. A 5% VAT will be levied on certain goods, following an agreement with the GCC in Jun’16. The move is in line with the IMF recommendation for Gulf States, to impose revenue-raising measures including excise and value-added taxes to help adjust to the low oil price environment that has slowed regional growth. The GCC countries have also agreed to implement selective taxes on tobacco, and soft and energy drinks this year.

The government of Oman has approached banks for an international bond issue with tranches of 5- and 10-years as the country plugs a budget deficit caused by lower oil prices. Oman’s budget deficit is forecast to be USD 7.8bn in 2017, and the finance ministry has stated that it would cover this year’s deficit with USD 5.5bn of international borrowing, USD 1bn of domestic borrowing and the drawdown of USD 1.3bn from financial reserves. Last year, the government raised a USD 1bn international syndicated loan in January, and issued tranches of 5- and 10-years international bonds worth USD 2.5bn in June, followed by another issue of USD 1.5bn in September.

Oil Market Review

Brent crude fell by 2 per cent to close the month at USD 55.7 per barrel, having maintained the price level at above USD 50 per barrel for all of January. OPEC nations Saudi Arabia, Kuwait, Algeria cut production in January more than they had originally committed to, while Russia followed suit and trimmed production faster than was initially agreed. However, rising US rig count and output put a cap on any oil price growth, as the US President had vowed to increase production.

Stay Tuned To Marmore MENA Insights!

Never miss a patch or an update with Marmore's Newsletter. Subscribe now!

Related Article

The uptick in MENA Eurobond issuances – A sign of things to come?

MENA debt issuances have touched record highs in Q1 2025. Will the uptick continue in subsequent quarters?

Read MoreKuwait’s Approval of Public Debt Law: Re-emerging on Investors’ Radar

Kuwait has passed the long-awaited debt law in March 2025. The blog explores the importance of the law, the expected benefits and outlook for the countrys return to debt markets.

Read MoreThe Dynamic Rise of Fintech in the GCC

The convergence of technology and finance is reshaping the GCC Financial Ecosystem. The blog explores key players, regulatory framework and market dynamics of Fintech in the GCC region.

Read More