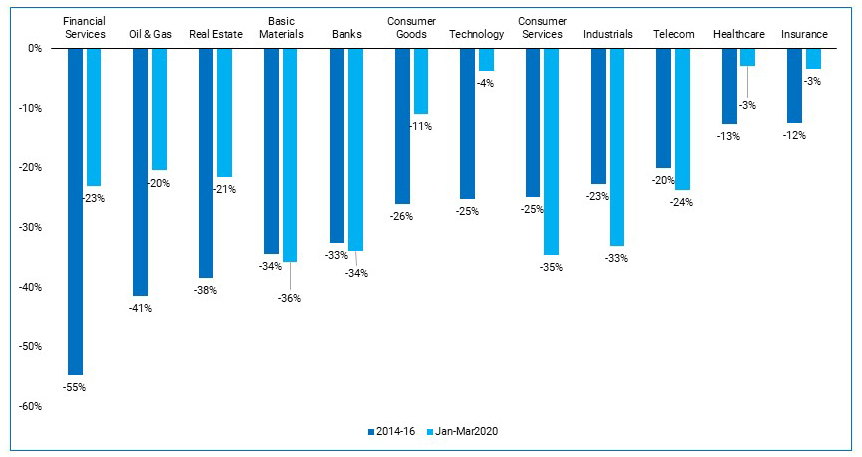

The 2020 market crash has been fast and short, if the trough of March 2020 holds. Lockdown to prevent the spread of COVID-19 brought about an uneven impact on sectors. While some sectors like airlines came to an absolute standstill, some sectors like technology stand to gain from the lockdown. These differences have reflected in the performance of equities too. A sector-wise comparison with the previous market crash of 2014-16 highlights the difference in COVID-19’s impact on sectors and what sets the current crisis apart.

Origin

Performance of sectors in bear markets depend on what caused the market crash. In 2016, oil prices had crashed by about 75% from their peak in 2014. This was mainly because of the supply glut caused by the U.S. shale oil production. As a country with oil-based economy, that had affected Kuwait’s equity markets too. The bear market was caused by a structural issue, causing a general economic downturn, affecting all sectors.

The decline in equities in 2020 was event-driven caused by – a) lockdowns implemented to contain the spread of COVID-19; b) decline in oil prices due to demand erosion on the back of lockdown and travel restrictions.

Figure: Comparison of performance of Kuwait’s Sector indices in market crash of 2014-16 and 2020

Source: Refinitiv; Note: Customer Services includes Hospitality, Airlines; Basic Materials includes Construction; Industrials includes Logistics; Time period for 2014-16 peak to trough decline – September 2014 to January 2016.

Sectors better off compared to 2014-16

Being essentials, consumer goods have seen less impact. As COVID-19 is a health crisis, the healthcare sector is bound to be a thrust area and is expected to see higher growth going forward. Financials services’ deeper fall in 2014-16 seems to be because of the higher valuations at that time.

The incorporation of technology in businesses has continued to increase and has come to be considered indispensable. Its importance has shot up further in a COVID-19 world. From smooth working from home, e-driven business/bureaucratic processes to data governance and cyber security, technology has become ubiquitous. All these make it an all-weather sector for current times.

Did You Know? Kuwait has the highest reserves among GCC countries, relative to its GDP at 542%. – Learn more

Though the oil prices have fallen in recent times too, the sector index has not fallen by as much as the previous crash. The reason could be that while the 2014-16 crash was systemic in terms of a supply glut with increase in shale oil production, the present fall has been caused by demand destruction that is driven by an event. In general, systemic issues tend to have a harder impact and slower recovery than external events (Goldman Sachs Research). The fall in prices so far has been of slightly less magnitude too. In the 2014-16 crash, the oil prices had fallen by 75% from peak to trough, whereas in the current crisis they have fallen by 65%.

Real Estate is another sector that has seen lesser fall in prices. While closure of businesses and reduced income levels would affect real estate in terms of sales and rent payments, the sector index’s fall has been less than that of 2014-16. This could be because though the sector was stable while entering 2020 (IMF ), it has not been at its peak as it had been in 2014. That could explain the decline of lower magnitude. Expectation of a smooth recovery after COVID-19 and resumption of business as usual could have also contributed to the lesser fall. The downside for the sector would be reduction in demand due to near term uncertainty over COVID-19 and expat repatriation.

Sectors worse off compared to 2014-16

Consumer services and Industrials have fallen by a greater margin than 2014-16. These are the sectors that have been particularly affected because of the lockdown. Supply chain disruptions and demand erosion affects sectors like logistics that constitute industrials. Travel restrictions have impacted consumer services comprising of hospitality and airlines. Implementation of social distancing in the near term might continue to weigh on the consumer services sector. Banks’ exposure to all sectors including the ones that have more affected by lockdown have caused the sector to fall by a slightly greater margin. Availability of construction materials, work stoppage to contain coronavirus spread have affected construction sector, contributing to the decline in basic materials.

The reasons for the difference in declines in sectors could be attributed to the nature of the crisis -2014-16 being structural and that of 2020 being event driven – and the lockdown measures. The question of whether markets have bottomed out persists, given the uncertainty over the coronavirus scare and the nature of economic recovery. But be it further fall or recovery, the trend in the impact on sectors is likely to hold.