MSCI includes Kuwait stocks in their Emerging Markets indices

Marmore Team

07 December 2020

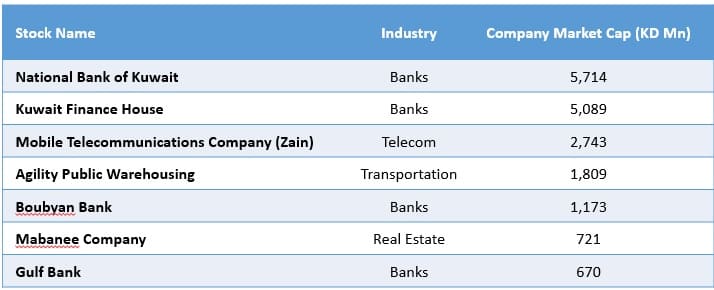

Morgan Stanley Capital International (MSCI), the world’s largest index provider, reclassified Kuwait to ‘Emerging Markets’ status from ‘Frontier Markets’. The inclusion to the Emerging Market Index took place on Nov. 30, 2020 after market close, while the deletion of Kuwaiti securities from the Frontier Markets 100 index will be phased over five successive index reviews. The implementation was originally slated to take place in May 2020 but was delayed because of the COVID-19 pandemic. Seven Kuwaiti Stocks have been added to the MSCI Emerging Markets Index at an aggregate weight of 0.58%. The list of stocks are listed below:

Exhibit 1: Kuwait Stocks to be included in MSCI Emerging Markets Index

Source: Refinitiv; Data as of November 29, 2020

According to Reuters, the move is expected to bring in at least USD 2billion in passive investment flows into Kuwait equity markets. Assets worth approximately USD 1.8 trillion track the MSCI Emerging Markets (EM) index and such passive investors would be mandated to invest in Kuwaiti stocks based on their weightage. MSCI had granted conditional approval for the inclusion of Kuwait in the EM index as part of MSCI’s 2019 Annual Market Classification Review held on June 25, 2019, paving the way for increased participation from foreign investors in Kuwait’s capital market and driving significant capital inflows to the country. As a part of the inclusion, Kuwaiti had instituted reforms like removal of foreign ownership restrictions for listed banks, change in the settlement cycle to T+3 for foreign and local investors. etc. As the Kuwaiti capital markets move more towards international standards, the outlook of foreign investors towards the country could also become positive. Greater inflows into the markets and the economy would encourage other domestic companies to list their companies on the stock exchange.

The article is an excerpt from our “Global & GCC Capital Markets Review: November 2020” report. Read more

Stay Tuned To Marmore MENA Insights!

Never miss a patch or an update with Marmore's Newsletter. Subscribe now!

Related Article

The uptick in MENA Eurobond issuances – A sign of things to come?

MENA debt issuances have touched record highs in Q1 2025. Will the uptick continue in subsequent quarters?

Read MoreKuwait’s Approval of Public Debt Law: Re-emerging on Investors’ Radar

Kuwait has passed the long-awaited debt law in March 2025. The blog explores the importance of the law, the expected benefits and outlook for the countrys return to debt markets.

Read MoreThe Dynamic Rise of Fintech in the GCC

The convergence of technology and finance is reshaping the GCC Financial Ecosystem. The blog explores key players, regulatory framework and market dynamics of Fintech in the GCC region.

Read More