According to Kuwait Financial Centre “Markaz” report on GCC stock & debt market outlook 2017, Boursa Kuwait has started this year on an explosive note. The much followed price index gained 16% while the weighted index gained by 11% as compared to 1.4% for MSCI GCC index and a negative 2.7% for Saudi Arabia. This has been among one of the sharpest rallies for Kuwait main index in recent years as the index posted positive gains for the fourteenth consecutive day. The surge in index is also matched by surge in liquidity.

While in the short run, a quick run up in the market is difficult to explain, in the long run stock market rally can only be sustained if there is concomitant increase in earnings. In the absence of healthy earnings growth, such sudden rise in market valuation will only feed speculators and invite fringe traders who will cause more harm than good for retail investors. It is clear that Kuwait and other GCC markets badly need active participation and support of institutional investors (SWF’s, mutual funds, etc.) in order to avoid hyper speculation. Regulators should engage with such institutional investors more actively in order to broad base their participation and encourage investment companies that manage funds and portfolios for such institutional investors. They will not only professionalize the market but can bring the much-needed stability in market activity, which will ultimately reduce volatility of the market.

There is a need to better align the institutional money in the market, best represented by mutual funds and portfolios managed by CMA licensed non-banking financial institutions. It is clear that KIA has shown a stable commitment to support the KSE since 1990’s when it launched and backed the mutual fund industry and continue to back it since then in many ways including governance. In addition to KIA, the CMA licensed companies manage portfolios and funds that best incarnate the values of CMA best represented by transparent, well governed, and research driven investment, and exceptional records in anti-money laundering (AML). Yet regulation, reaching the right balance between regulations and restoring market confidence through a spirit of partnership seems to be the missing variable, especially to those investment companies that managed to survive the crisis and grow. Such CMA licensed financial sector companies are the natural gates towards institutional investment to avoid any unwarranted euphoria or speculation.

At the beginning of 2016, we were positive on UAE while being neutral on Saudi Arabia, Kuwait and Qatar. UAE (especially Dubai) was the outperformer in GCC markets, which was in-line with our expectations. Saudi Arabia stock market also returned positive helped by the recovery in oil prices towards the end of the year. Kuwait and Qatar ended the year flat. The overall S&P GCC index returned 9.5% in 2016 with better performance coming in the second part of the year. Despite over 50% rise in oil prices, investors seemed to take a wait and watch position before investing in the stock markets. This could be on account of poor corporate earnings growth and lower capital expenditures by GCC governments.

Economy

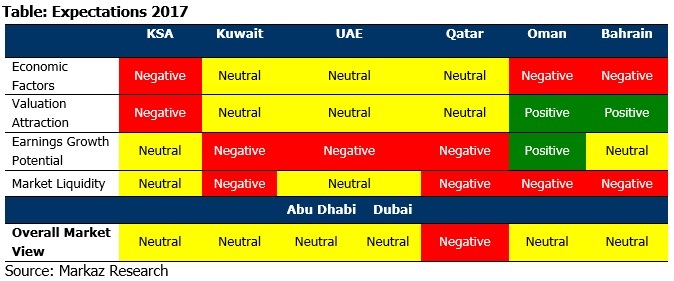

Qatar is expected to have the highest non-oil GDP growth rate (5.2% for 2017) in the region on account of the spending on infrastructure projects. In the recent budget, USD 25 Bn or 47 percent of the budget is earmarked for the completion of projects related to FIFA 2022. As of November 2016, Kuwait has awarded close to $12 Bn worth of contracts. Close to 58% of the projects awarded has been from the non-oil sector. Kuwait is in a favourable position when it comes to fiscal and current accounts. Overall we are Neutral on Kuwait, UAE & Qatar while Negative on the rest of the GCC on economic factors.

Earnings

Growth in the overall earnings for GCC countries is expected to be flat at 0.3% for 2017 as GCC governments cut down on budget and welfare spending. Economic heavyweights of the region – Saudi Arabia, Kuwait and Qatar saw their corporate earnings decline by 3.6%, 3.4% and 7.8% respectively while that of UAE remained flat during 2016. Oman’s earnings witnessed a turnaround in 2016 and grew by 5.5%. 2017 could perhaps be seen as a year of consolidation and GCC corporates adjusting themselves to the new normal.

Valuation

Stock market returns for the GCC region, in 2016, with the exception of the UAE were either flat or marginally negative. As a result of this, the stock valuation levels have drifted away from the fundamental values. For instance, Price-to-earnings multiple for Saudi Arabia currently stands at 17.5x followed by Kuwait at 17.1x, and, in comparison with other major GCC markets such as UAE (P/E 12.2x) and Qatar (P/E 13.5x) they are trading at a premium. As a result, we are negative on Saudi stock market from a valuation standpoint while we remain neutral on Kuwait, UAE and Qatar. We are positive on Oman and Bahrain on account of higher dividend yields of 5% and 6% respectively.

Market Liquidity

GCC stock markets have had some of the lowest levels of turnover in 2016 clocking in a turnover ratio at 34% despite the emerging market status of Qatar and UAE. Even the recovery in oil price during the 2nd quarter failed to increase the interest of investors in the region. Poor earnings growth in many of the key sectors, especially banks, did not augur well for improving the liquidity in the stock markets. We are Neutral on Saudi & UAE while Negative on the rest from liquidity point of view.

Overall Ratings

Saudi Arabia – Neutral

Saudi Arabia is entering an interesting phase now. It is undertaking a number of reforms, which are aimed at reducing the fiscal burden and increasing the employment opportunities for its youngsters. These reforms could cause some slowdown in the economy as the citizens adjust themselves to a new normal. Insurance sector continues to grow in the country despite the slowdown and is expected to continue in 2017 while construction related companies could suffer as government increases scrutiny on projects. Consumption could take a hit as a result of reform measures, which is why we have given a neutral rating for Saudi Arabia.

UAE – Neutral

Dubai is looking to continue its spending on account of the Expo 2020 as most of the infrastructure projects enter the final phase of the building process by early 2018. Areas like tourism, finance, hospitality, trade should continue to grow in 2017. Abu Dhabi, on the other hand, has been prudent even during boom times and has comfortable reserves to tide through 2017. Despite this, the global market for oil is expected to remain subdued. Real estate, one of the main drivers of UAE’s growth could take a hit in 2017 as sales are stagnating. As a result, we expect UAE to be neutral in 2017.

Qatar – Negative

Qatar is an interesting case. On the one hand, the government is spending on account of the 2022 FIFA world cup and targets a budget breakeven while on the other hand the financial sector of the country has suffered the most owing to government drawdowns. Telecom sector has been performing well in Qatar and is expected to continue it in 2017. Banking could take a hit as lower deposits could hamper credit growth. Valuations have not gone down in line with fundamentals, which is why we are negative on the Qatari market.

Kuwait – Neutral

Kuwait has seen lot of positive signals going for it during 2017. Its project awards market is witnessing a turnaround as a number of projects were awarded in 2016. The project awards trajectory has been quite positive. Banks in the region are better placed compared to its GCC peers and are likely to perform well in 2017 while real estate could suffer negatively owing to stagnant sales, price declines and negative sentiment. The market is fairly attractive and there are some capital market reforms that are on cards that is expected to augur well for the market.

GCC Debt Market Outlook 2017

The prolonged period of low oil prices has put a strain on government budgets across the region, exposing the dependence that GCC economies have on oil revenues. Saudi Arabia, Oman and Bahrain have all scrambled to raise funds through bond issuances to compensate for the fall in oil revenues. Their sovereign rating was also downgraded in 2016 on back of widening fiscal balance and sluggish economic growth. However, Saudi Arabia with its “A1” rating remains in the investment grade while Oman (BBB-) and Bahrain (BB – Junk) have lower ratings. The ratings downgrade has had a visible impact on the pricing of the bonds. KSA had to pay 185bps over the 10 yr US treasury bond while Oman had to pay 320bps over the 10 yr treasury bond. GCC governments should carefully consider their borrowing and investment decisions while maintaining significant liquidity buffers for protecting themselves against short-term funding risk. Saudi Arabia, Kuwait, Qatar and UAE have significant headroom for borrowing as they have very little public debt outstanding. There is room for taking on more debt; however, it should be done only after careful considerations of the implications of building up debt and the impact of borrowing on domestic liquidity, credit, and central bank reserves. We expect GCC governments to cumulatively issue over USD 74 billion of debt in 2017.

Stay Tuned To Marmore MENA Insights!

Never miss a patch or an update with Marmore's Newsletter. Subscribe now!

Related Article

The uptick in MENA Eurobond issuances – A sign of things to come?

MENA debt issuances have touched record highs in Q1 2025. Will the uptick continue in subsequent quarters?

Read MoreKuwait’s Approval of Public Debt Law: Re-emerging on Investors’ Radar

Kuwait has passed the long-awaited debt law in March 2025. The blog explores the importance of the law, the expected benefits and outlook for the countrys return to debt markets.

Read MoreThe Dynamic Rise of Fintech in the GCC

The convergence of technology and finance is reshaping the GCC Financial Ecosystem. The blog explores key players, regulatory framework and market dynamics of Fintech in the GCC region.

Read More