The first round of production cuts was agreed in November 2016 and was effective during January 2017 and was aimed at cutting down 750,000 barrels of oil per day from the global supply. Second round of the production cuts announced in May 2017 is aimed to take out 1.8 Mn barrels per day which is aimed at balancing the market. While most of the countries have agreed to the cut, some of critics of the plan point out that the efficacy of the previous plan, saying that this planned cut in output cannot achieve in nine months what the plan could not achieve in the previous six months. OPEC’s influence seems to be waning with the rise of alternative supplies, it is no more able to influence prices through production cuts alone as shale producers are more than eager to fill the void and make any production cut exercise null and void. To counter this, we feel the OPEC should do two things.

- Impress non-OPEC members to keep their share of bargain (especially Russia) and

- Talk to U.S shale players on co-operating and co-existing

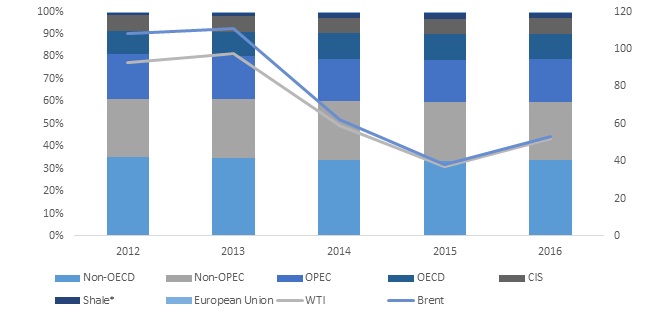

Oil Prices and the growth of Shale oil

Monitoring the output

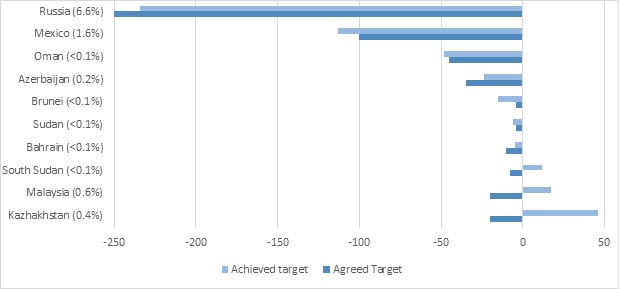

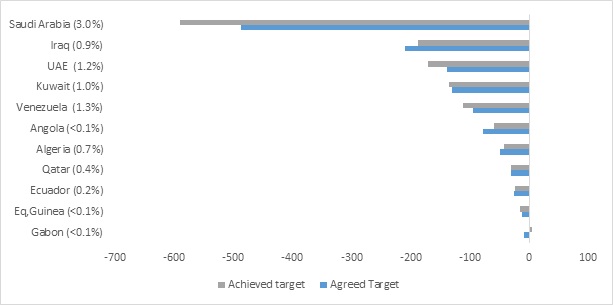

Getting the non-OPEC countries to play along would be first and foremost challenge for the OPEC members. Drastic cuts in production might not be welcome by all of the participating nations; Non-OPEC countries that participated in the previous cut fell well short of their production targets while OPEC countries cut production by more than what they promised at 111% (During April and Mar 2017 it was at 111% during; During February and Jan 2017 they were 97% and 99% respectively). It’s the output from larger players that really count – Russia and Mexico, being the two largest producers outside of the OPEC region. While Mexico has exceeded its agreed commitment, Russia fell well short of its reduction commitment at 78%. However given their renewed commitment to extend the cut till March 2018 indicates that low oil prices is causing trouble there as well, Russia could very well nudge its companies to fall in line.

Another way to ensure compliance with the given targets is by making the oil production data more transparent. A weekly data of production submission among the OPEC and non-OPEC members would help in speedier correction and in ensuring better compliance with the agreed plan. There could be executive level meetings that could be held on a monthly or fortnightly basis in order to share production data and generally be aware of each other’s production activities.

Talking with the U.S shale players on co-operating and co-existing

Shale oil producers are here to stay and their rise as an alternative supplier in the market seems inevitable and even welcoming for countries like India, the third largest consumer of the commodity. India recently even announced that they are looking forward to have more supplies from new market such as the US. In such a scenario, this would be right time to open a dialogue with the shale producers. Information asymmetry across both these groups is leading to a zero-sum game, any loss of OPEC’s market share is a potential gain for Shale oil suppliers.

Shale firms need OPEC to achieve its objective of reducing global oil stockpiles and raising prices. And OPEC needs shale producers to be cautious in enormously growing output to avoid undermining its policy of supply restraint. Warming up to each other through frequent meetings and dialogues are the only way to ensure that both the opposing parties are working towards the fulfilment of a larger goal instead of their own self-interest. The U.S shale producers could also use some of the critical insights into OPEC method of thinking to better develop co-operation strategies. While a full-fledged co-operation might not be possible owing to the sheer number of companies and the legal penalties involved it could be a small start that possibly could set out a new path for oil.

OPEC could use this opportunity to revisit some of its strategies in oil pricing and might as well increase its cooperation with traders and hedge fund managers. Given the rise of alternative supplies from US and other unconventional source, OPEC’s influence on over oil supply and price might have waned but it still remains at the centre a new dawn for global co-operation on oil.

Among non-OPEC Russia holds the key for output reduction (000’s)

OPEC Stands by its promise of reducing oil output (000’s)

Source: Bloomberg, IEA Estimates and other secondary sources – Figures in brackets represent refining market share as of 2016.