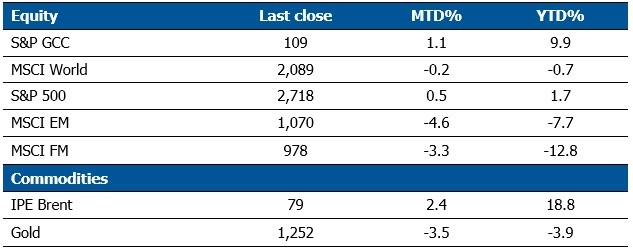

According to our recently released Monthly Market Review for the month of June, GCC Stock Markets continued to post positive results, marking another positive month. The S&P GCC index was up 1.1% for the month and is now up 9.9% for the year, making it as one of the best performing regions in the world. Both MSCI EM and MSCI World were negative for the month. MSCI EM shed 4.6%, while, MSCI World lost 0.2%. The performance of S&P GCC index was supported by a good show by Saudi Arabia following favorable news flow including MSCI inclusion and increased oil production while other GCC markets were mixed during the month. Tadawul added 1.9% for the month brining its overall gains in 2018 to 15.1%, the highest in the GCC region. This is in sharp contrast to the Dubai market that has so far lost 16.3% for the year.

Global Market Trends – June 2018

Source: Reuters

Zain and Ooredoo were the top gainers amongst the blue chips companies in GCC for the month, rising by 16.0% and 8.4% respectively. MSCI’s decision to include Kuwait for its annual classification review for 2019 which was announced close to the end of the month, proved to be a boost for Kuwait’s blue-chip stocks whose prices consequently witnessed a rebound. Saudi Arabia, which was the best performing GCC market during H1 2018 with YTD returns of 15.1%, had a turbulent month, with its stocks rallying back and forth due to uncertainties over OPEC’s oil output announcement and a mild market correction after the MSCI upgrade, eventually posting a gain of 1.9% for the month. Anxiety over Dubai’s property market outlook weighed in on its equity index as major real estate and construction players like Emaar Properties and Drake & Scull International posted negative returns.

MENA Market trends

The uptick in oil prices have buoyed GCC countries, who have resumed their capital spending to revive the economic growth that has stagnated in the recent past. In Abu Dhabi, Sheikh Mohammed Bin Zayed announced a USD 13.6 (50 billion dhirams) economic package to attract new sectors, industries, investments and to create 10,000 jobs for locals in the next couple of years.

On the other hand, the cost of insuring Bahrain’s sovereign debt against default hit a new high as investors concern over the country’s debt burden fanned fears following U.S interest rates hike.

Meanwhile, investors spat at the private equity firm – The Abraaj Group, has hurt investors’ confidence, renewed concerns over governance and internal systems, and threaten to stunt the development of the nascent private equity industry in the region.

Oil Market Review

Fall in production of Venezuela and Libya in addition to the reduced output from Iran due to U.S. sanctions have been supportive in keeping oil prices higher than 2017 levels. The expectations of an increase in oil output promised by Saudi Arabia and Russia failed to keep prices down as Brent crude prices surged by 2.1% for the month. The YTD gains have remained solid at 19.8% and is expected to sustain its level due to continued supply disruptions from other OPEC members and a brewing trade war between the U.S and its major trade allies. Because of the ongoing tussle between the U.S. and China, if China imposes a 25% duty on U.S crude imports, American supply would become uncompetitive, forcing Chinese buyers to look at alternate suppliers. The constant shift in dynamic of the oil markets is expected to keep prices on the higher side for the near future.

Stay Tuned To Marmore MENA Insights!

Never miss a patch or an update with Marmore's Newsletter. Subscribe now!

Related Article

2024 Kuwait Banking: Interest Rates and NIM Trend Analysis

The blog discusses how net interest margin of Kuwaits banks has moved across interest rate cycles, in light of awaited policy rate cuts.

Read MoreAre ESG and Sustainable investing the same?

ESG and Sustainable Investing might seem to be related but both are distinct concepts. The GCC nations transition towards cleaner energy portrays a buoyant outlook for ESG and sustainable investing.

Read MoreBusiness Impact of IFRS Sustainability Standards for GCC

The impact of the recently issued IFRS sustainability standards, once adopted, is likely to be high, as GCC companies scramble to allocate adequate resources for the adoption.

Read More