According to a Ifri-Markaz report published in 2012 called ‘Powering Kuwait into the 21st Century: Alternatives for Power Generation’, it was pointed out that the GCC region is facing gas shortages and Kuwait ranks independency of supply among its policy priorities, renewable, and in particular solar have their own place in the power mix. The paper also called for further fleshing out the renewable energies target in Kuwait with more specifics. Moreover, the concept was highlighted that the gradual introduction and commercialization of renewable energies could help support a strategy to diminish power subsidies over future years.

With rapid developments taking place in the solar energy sphere in the GCC, now is the time to make sure that such policy recommendations are pursued with more vigour. The window of opportunity could otherwise be closed for some more time, as the dampening of international oil prices is causing some turbulence in the development of the renewable energies sector on the international scene.

Over the past several decades, the countries of the Gulf Cooperation Council (GCC) countries have depended on oil as the main source of national income and for powering the domestic economy. However, with the growing need for more power, domestically, and with the imperative of growing industries for economic diversification, there is the need to diversify away from the use of oil into renewables in the interest of sustainability. A key driver supporting the push towards renewables, particularly solar energy, is the rapid slide of prices in solar generation costs.

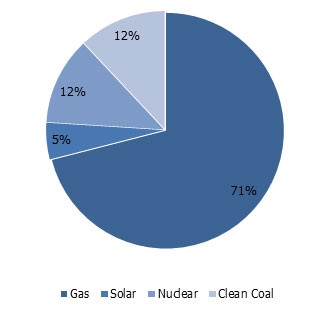

There are increasing instances of solar power projects in the GCC. For instance, as part of its energy diversification objectives for 2030, Dubai (the UAE) launched the HH Sheikh Mohammed bin Rashid Al Maktoum Solar Park in 2012. The park commenced with a 13MW solar PV facility in 2013 and targets to generate 1,000 MW by the middle of 2017. In Qatar, the Qatar Solar Energy company launched a solar-panel factory in 2014, which has the ability to generate 300mw of energy every year. The plan is to ultimately reach a production level of 2.5GW annually. Kuwait and the Kingdom of Saudi Arabia are also reportedly planning large solar power projects in order to diversify the energy mix. The long-term trend points to the fact that solar energy will play an integral role in the energy diversification agenda. The following figure provides the energy mix strategy of the Dubai Supreme Council of Energy (DSCE) with respect to 2030.

Image Source: Dubai Electricity and Water Authority (DEWA)

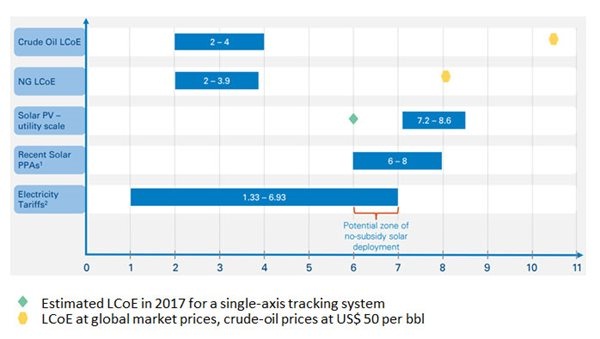

Over the past five years, the costs of solar Photovoltaics (PV) modules and systems have declined by about 65–70%. This has reduced solar’s levelized cost of electricity (LCoE) dramatically. In areas with high solar-irradiation, the cost of generation of solar energy is now about $100/MWh. Thus, solar energy’s competitiveness has improved, which makes it a far more affordable proposition for countries in the GCC, in terms of developing the market without resorting to expensive subsidies.

Figure: GCC – Unsubsidized Deployment of Solar Energy can be Realized by 2017 1: DEWA Solar PV Project, India First Solar Project

1: DEWA Solar PV Project, India First Solar Project

2: KSA electricity tariff sliding scale. The avg. unit cost of electricity in KSA is US cents 3.89 per kWh which includes transmission and distribution costs.

* NG is natural gas and PPA is ‘power purchase agreement’

Image Source: Arthur D. Little

There have already been announcements by several GCC countries with respect to the targeted solar energy output. The following table provides a snapshot of the goals of the various GCC countries with respect to solar energy and the current rate of activity.

Table: GCC Solar Energy Developments

| Country | Target (MW, Year) | Year Announced | Installation as of 2014 (MW) | Under Construction (MW) |

| Saudi Arabia | 41,000 (2040) | 2012 | ~50 | 50 |

| UAE – Dubai | 1,000 (2030) | 2011 | 13 | 200 |

| UAE – Abu Dhabi | 1,600 (2020) | 2009 | 110 | – |

| Oman | 200 (2020) | 2012 | – | – |

| Kuwait | 2,000 (2030) | 2012 | – | 50 |

| Qatar | 1,800 (2020) | 2012 | 4 | – |

| Bahrain | No Announcements | – | 5 | – |

| Total | ~ 48,000 | ~ 180 | ~300 |

Source: Arthur D. Little

There is little doubt among many experts that the GCC region can prove very competitive in terms of solar energy generation costs. For instance, in Saudi Arabia, it is possible to achieve a solar LCoE of around $70/MWh in the higher irradiation/elevation areas in the western parts of the Kingdom. In the areas close to the Gulf with respect to the Kingdom, the LCoE can reach about $90/MWh, which is still quite competitive in comparison with the international benchmark of $100/MWh. Some GCC countries have ambitious renewable energy plans, in which solar energy will play a key role. However, it should be noted that the objectives can vary in consistency across the region. Kuwait has renewable energy targets, which incline upwards in a phased manner, ranging from 1% (mix undefined) renewables-based power generation by 2015 to 10% (~ 7.7 GW) by 2030, and 15% by 2030.

Table: Renewable Energy Targets in the GCC States

| Country | Target (MW, Year) |

| Bahrain | 5% by 2020 |

| Kuwait | 1% of electricity generation by 2015; 10% by 2020; 15% by 2030 |

| Oman | 10% of electricity generation by 2020 |

| Qatar | At least 2% of electricity generation from solar energy sources by 2020 |

| Saudi Arabia | 50% of electricity from non-hydrocarbon resources by 2032: 54GW from renewables (of which: 41GW from PV and concentrated solar power (CSP), 9GW wind, 3GW waste-to-energy, 1GW geothermal), 17.6GW from nuclear |

| UAE | Dubai: 5% of electricity by 2030; Abu Dhabi: 7% of electricity generation capacity by 2020 |

Source: Oxford Institute for Energy Studies

Governments in the GCC are taking proactive steps to push the adoption rates for solar energy. This is evident in the case of Kuwait, where in May 2015, it was announced that the Ministry of State for Planning and Development was studying a proposal to oblige all cooperative societies in Kuwait to use renewable energy. As part of the plan, PV systems would be used in cooperative societies, thus saving energy and money, apart from safeguarding the environment. From the UAE, reports emerged in May 2015 that the fall in the cost of the country’s solar powered energy sources has achieved parity with cost of fossil fuels, making solar economical and commercially viable for the UAE.

There are also reports of important breakthroughs in research in terms of solar that are coming out of the GCC. For instance, in June 2015, the Qatar Environment and Energy Research Institute (QEERI) claimed that it has discovered the chemical mix of a new material that could render the harvesting of solar energy far more economical. According to scientific experts in Qatar, solar irradiation supplies the country with the yearly equivalent of 1.5 million barrels of oil per square kilometer. However, much of these remains underutilized or wasted due to the relatively high cost of harvesting the latent energy, thus making it an unattractive proposition for traditional energy players. However, with new research outputs coming from domestic institutions, Qatar expects to take rapid forward steps in terms of actualizing solar energy generation on an industrial scale. Meanwhile, Oman is studying a plan to establish four solar power projects, as pilot ventures, as proposed by the Rural Areas Electricity Company (Raeco). The following table provides the locations and the capacity of the planned solar projects in Oman.

Table: Proposed Solar Pilot Projects in Oman: Location and Capacity

| Location | Planned Capacity (in KW) |

| Ibri | 2,000 |

| Sharqiya | 2,000 |

| Mudhaibi | 2,000 |

| Dhofar | 500 |

Source: Raeco (Oman), Zawya

The GCC could also take note of the developments in other parts of the Middle East in terms of renewable energies, especially solar in particular. Countries like Jordan and Egypt have recently created legislations that provide a framework for renewable energy projects. Such measures are intended to provide a layer of government backing for large scale renewable energy projects, which may include steps like guaranteed tariffs for generated power and governmental guarantees for project developers.

Stay Tuned To Marmore MENA Insights!

Never miss a patch or an update with Marmore's Newsletter. Subscribe now!

Related Article

The uptick in MENA Eurobond issuances – A sign of things to come?

MENA debt issuances have touched record highs in Q1 2025. Will the uptick continue in subsequent quarters?

Read MoreKuwait’s Approval of Public Debt Law: Re-emerging on Investors’ Radar

Kuwait has passed the long-awaited debt law in March 2025. The blog explores the importance of the law, the expected benefits and outlook for the countrys return to debt markets.

Read MoreThe Dynamic Rise of Fintech in the GCC

The convergence of technology and finance is reshaping the GCC Financial Ecosystem. The blog explores key players, regulatory framework and market dynamics of Fintech in the GCC region.

Read More