This article originally published in Khaleej Times.

The Arabian Gulf or the GCC region’s retail sector has been going through sweeping changes that are not only disrupting the conventional retail but reshaping its future too. In recent times, the mode of retailing in the GCC has gone through substantial changes that was unimaginable a few years back. There are clear signs of transformation in the retail sector in the region. There is increasing scope for e-commerce in the Middle East, with Saudi Arabia and the United Arab Emirates establishing the template for sustainable business models that other countries can look to emulate ( Fitch Solutions-Middle East E-commerce 2018).

Over the last decade, e-commerce industry has grown 1500% in the region. In terms of average spending, an online user spent US$300 in the UAE compared to US$90 in Saudi Arabia, US$94 in France and US$1100 in Canada in 2017 (Albawaba-UAE the next E-commerce capital-2018). However the size of e-commerce in the GCC region is relatively smaller. According to estimates, e-commerce just stood 2% of the total retail sales in the region in 2017 with the UAE taking the lead, followed by Saudi Arabia (The National and MR Raghu MD Marmore MENA Intelligence 2017).

GCC e-commerce market was estimated at US$3.4 Bn in 2015, US$4.8 Bn in 2016, US$6.7 Bn in 2017 (Arabian Gazette- E-commerce Market Value in MENA 2017). Marmore research predicts it to reach US$20 Bn by the end of the decade, i.e 2020. The table below summarizes various predicted values for expected size of the market by 2020/22.

Table 1: Various Estimates of E-commerce market size in GCC countries 2018

Source: Marmore and Secondary Research 2018

The ripple effects of digitized commerce will be wide and deep, directly impacting the conventional physical stores (retail industry), employment and the logistics sector. The growing youth population, higher mobile and internet penetration, high disposable income and booming FinTech industry, are expected to propel digital commerce. In the GCC, mobile penetration is recorded at 76% of the total population, and internet connectivity is reaching above 90% of the population in countries such as Bahrain, Qatar and the UAE (GSMA the Mobile Economy 2017).

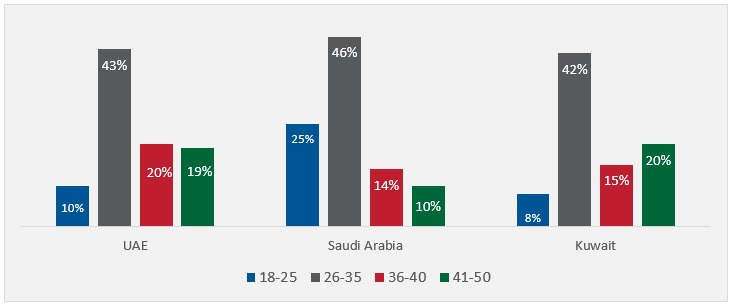

In the GCC region, 73% of total mobile subscribers are having mobile internet, while smart phone adoption is 72% as on Q2 2017. Additionally, GCC regions top the other Arab countries and MENA in terms of technology adoptions and utilization (Ibid ). In terms of demographics, almost 50% of the population between 26-35 years prefer online transactions in UAE, Saudi Arabia and Kuwait. Younger population groups tend to have lower internet utilization. Similar is the case for higher and middle-aged population across 3 GCC countries, as shown in chart below.

Chart 1: Online Purchase Activity by Age Group 2017

Source: Service Plan Middle East 2018

E-Commerce Ecosystem

In 2017, when Amazon acquired Dubai-based online retailer, Souq.com, it changed the rules of the online game forever in the Middle East. According to reports, Amazon paid US$850 Mn for Souq (Tech Crunch-Amazon Completes Acquisation-2017). The acquisition not only established Amazon’s footing in the region but also heated up the e-commerce competition and helped formalize the structure of the sector.

Table 2: Key E-commerce Market Players in the GCC

Source: Sayidaty Digital Group-Brining Commerce and Content together 2017

Surprisingly, while more than half of the population is under the age of 25 in the region, (Youth in the GCC-Booz & Co. 2017) only 15% of businesses in the region have their online presence (Practical E-commerce 2017). On the demand side, the key reasons for the rise in e-commerce are, namely, ease of shopping, new payments mechanisms, development of FinTech, multiple merchant points, rise of e-wallets and other alternative payment systems (ICT report-E-commerce in Saudi Arabia). Thus there is an increase in consumers’ willingness to use and accept such technology. On the supply side, the wide range of shopping brands to choose from is one of the prime factors driving the e-commerce market. Huge investments, innovation in consumer mobile devices and connectivity, entry of new players, competitive prices, expanding logistics services are the other key factors shaping the e-commerce market in the GCC region.

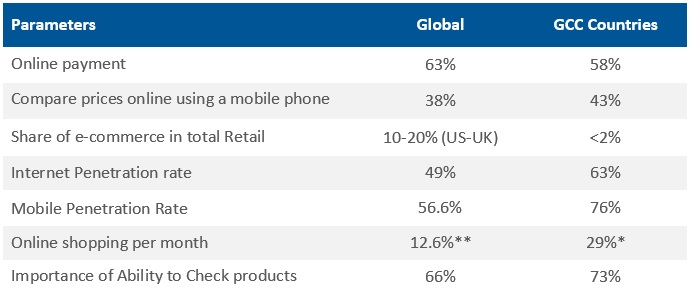

Table 3: E-Commerce Benchmarking

Source: Secondary and Marmore Research 2018. *approximately**Asia Pacific region 2017 of the total retail sales

Culturally, GCC countries are mainly cash-driven. Although mobile and internet penetration is high compared to global standards, the urge to touch and feel the physical product and, to some extent, a mild distrust in online payment mechanism have emerged as challenges before the region’s e-commerce market. In an environment of cultural conservativeness and technology evolution, Middle East is yet to embrace e-commerce on a full scale. The Table above provides the insights into online customers’ psychology.

Although the e-commerce growth in recent times has been phenomenal, complete trust and confidence in the system is yet to develop among the GCC population. In Bahrain, for instance, product search and data collection are among the top online activities, and online shopping is done by less than one-third of internet users. Also, in countries with higher online shopper penetration rates, such as the UAE and Saudi Arabia, the frequency of buying online remains subdued (PN News Wire- GCC B2C commerce market report 2018).

Overall, the key pressing issues before the e-commerce sector are summarised below:

– Prevalence of cash-on-delivery over other payment methods and consumer wariness of safer online payment transactions.

– Most of the countries lack a unified address system which, on the one hand, creates challenges for last-mile delivery.

– Extensive use of mobile phone to trace customer location (PN News Wire 2018) makes delivery difficult.

– Lack of a well-developed unified online payment system.

The online payment infrastructure is still in the evolutionary stage in the region and lacks deeper public trust. In Saudi Arabia, for example, about half of the population remains unbanked and card payment penetration is just over 40%. In terms of logistics, most of the online retailers don’t have well established warehouses and the distribution network is still weak (AT Kearney-Getting in on the GCC E-Commerce Game 2017).

Strategies to drive e-commerce transactions in the GCC

Given this background, some of the strategies to improve the ecommerce transactions in the GCC are discussed below:

For consumers in the Middle East and Africa, price-points or promotions (34%) are the most likely factor driving purchasing decisions, followed by brand (24%) (KPMG). This makes personalised messages and product recommendations crucial. Promotions using data-driven marketing and deep learning (a subfield of AI) can be widely used to understand the individual’s shopping wallet. Entry of new players can increase competition and add better quality of customer service and better discounts.

As exhibited in Table 3, a majority of regional customers prefer to check products personally. In such a case retailers may use strategies like providing comprehensive information about the product ingredients, easy returns and satisfaction guarantees. Also, understanding the motivation of shoppers, their behaviour pattern (behavioural targeting) through browsing patterns can improve the services offered by online retailers and make people transact more online.

In order to improve the payment method, online retailers and local banks can leverage new forms such as QR code payment method which would enhance customer convenience. Online retailers providing “bank transfer” option at checkout can offer a dynamic QR code via app that consumers can scan using their mobile banking app and confirm the payment. In China, the ICBC’s (Industrial and Commercial Bank of China) QR code payment is used for all small payment services, thus speeding up the e-commerce payment experience. Such payment methods can also be more secure as the payment information is not carried through the merchant’s store network.

Thus the e-commerce platforms can increase the outreach of customers in the region by redesigning the digital solutions that can increase speed, convenience and visibility. In addition, regulatory drivers like cashless societies, financial inclusion, protecting customers and more open banking competition can increase e-commerce transactions in the region. Though the GCC region is a late adopter of e-commerce, regionally tailored solution and strategies like improving the customers’ trust, better logistics, reliable online payment system and increasing competition among the e-commerce players can offer great results.