This article was originally published in Argaam

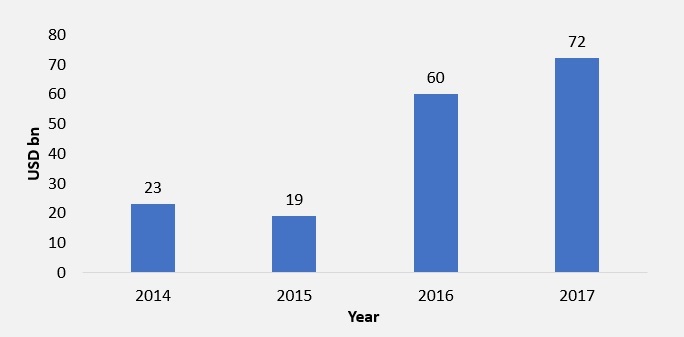

The bond market in the GCC region saw bond issuances to the tune of USD 70 bn, an all-time high issued amount in the year 2017 (https://www.thenational.ae/business/markets/strong-appetite-for-gcc-credit-forecast-for-2018-1.699843) The first quarter of 2018 has already seen issuances worth USD 16.8 bn, mostly by Oman (39% approx.) and Qatar National Bank (22% approx.). Oman has managed to sell its largest ever sovereign bond worth USD 6.5 bn in face of multiple downgrades in credit ratings from companies like Moody’s and Fitch in 2018. All of these show that although there exist certain challenges for GCC bonds, there is a growing demand for them from investors across emerging and developed markets. With the expectation that 2018 will also see a strong issuance of bonds, let us look at some of the reasons that are fuelling the appetite for Gulf bonds in the bond market.

GCC USD Issuances (USD bn)

Source: ENBD AM, Bloomberg;

Note: Includes issuances of USD 250 mn and above. Contains both sovereign and corporate issuances

Increased Interest from Foreign Investors

GCC bond markets have seen a surge in foreign investment in the last two years. More than 75% of the issued bonds (mainly the sovereign bonds) in 2017 were comfortably absorbed by non-GCC investors. This can be seen when a USD 750 mn bond issued by National Bank of Kuwait had 57% as U.S investors, followed by 26% Middle East investors, 13% European and 4% Asian investors in May, 2017. This is in stark contrast when the same bank issued an USD 700 mn bond which had 43% as Middle East investors and only 2% as U.S investors in 2015. The Oman bond also saw 93% of investors as non-GCC. Investors who couldn’t avail sovereign bonds due to non-availability caused by increased demand, subscribed to bonds issued by the regional banks and corporate issuers. This increase in investment is backed by improved macro fundamentals in the region supported by the gradual increase in the oil price, translating into improved credit profiles of local companies (Jebel Ali Free Zone was upgraded from B2 to B1, Dubai Electricity and Water Authority was upgraded to a stable outlook with a Baa3 rating) and government.

Impressive Performance by GCC Bonds

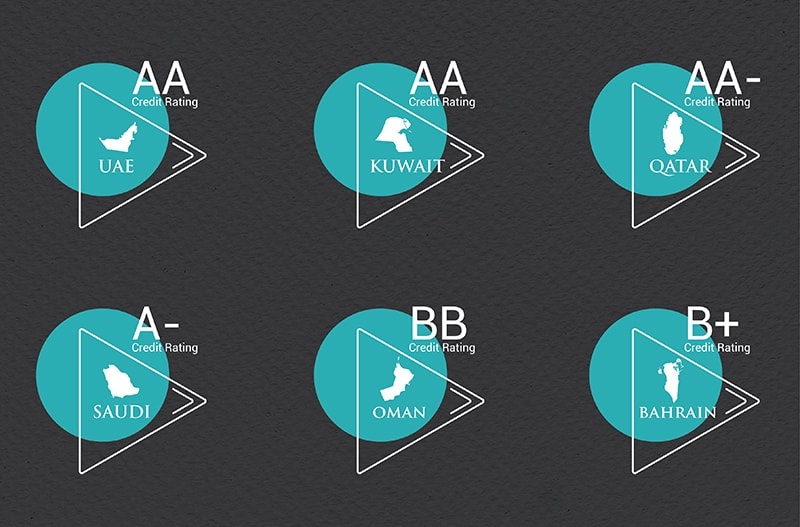

With an approximate 12% share in Bloomberg Emerging Market Investment Grade Bond Index, GCC bonds have occupied centre stage in the debt market landscape. Stable credit profiles, low debt levels and rising oil prices have increased the appetite for GCC bonds. Further, the bonds are priced attractively with yields that are higher than that of their similarly rated peers. For instance, Saudi Arabia 30yr bond maturing in 2047 yields 30bps higher at 5.07% than Indonesian bond (30yr, 4.78%) which has a lower credit profile compared to KSA (http://businessweekme.com/2018/04/19/bonds-gulf-safe-place-hide/). Similarly, Qatar debt due in 2028 has a yield of 4.45% as compared to 4.15% compared to a Mexico bond with same maturity period and having a lower rating compared to Qatar (http://businessweekme.com/2018/04/19/bonds-gulf-safe-place-hide/). The region also offers a mix of credit rating for wider investment opportunities – from ‘AA’ rating of Kuwait and Abu Dhabi to ‘BBB-‘of Oman. One primary reason for higher yield is due to the risk premium associated with the GCC bonds for heightened political risk. Among major developed economies like Europe (almost 60% of sovereign bonds) and Japan (https://www.investing.com/rates-bonds) have negative yields and investors are looking for bonds with positive yields, which is driving the demand for GCC bonds. Benchmark eligibility has also contributed to higher performance of the bond.

Sovereign Credit Rating of GCC Countries

Source: S&P Global (Foreign currency ratings)

US Rate Hike

With the U.S fed signalling that they would raise interest rate three times in 2018, governments and corporates in the GCC will be looking down to take advantage of the current lower interest rates by issuing more number of bonds in the market. If there is a rate hike, the central banks of the region will be under pressure to raise interest rates. This will raise the yield rate of the bonds. The issuers will like to lock down the borrowing cost at the current rate which will benefit them greatly and hence they are likely to increase the issuance of bonds as soon as possible to raise capital in order to fulfil their current and future capital requirement.

Improved Structural Reforms

For sometimes now, GCC countries have begun implementing structural reforms. Some of these changes include developing independent regulatory, statistical, budgeting and auditing bodies for public sectors. Increased transparency and accountability with trade liberalization and prudent principles for public debt management and creating an environment that shall facilitate ease of doing business. This will lead to increased investor confidence in the regional bond market. This will also bring about a wide range of economic benefits that would ultimately result in better credit ratings and translate to lower cost of borrowing for the issuers.

A recent milestone achieved to develop domestic debt market, is the listing of more than 200 bn riyals of government and sukuk bonds in the stock market by KSA. This will help in the secondary bond market, bridge fiscal deficit for the country and reduce reliance on banks for debt. It will also help in making transparent benchmark prices for bonds in KSA.

Stable CDS Spread

With most countries in GCC having a decreasing or stable CDS, the outlook on bond market looks positive. A stable CDS spread shows that the investors are focusing more on the positives in the market including the rise in oil price, increased interest by foreign investors and diversification in non-oil economies instead of risks associated with GCC bonds especially the geopolitical ones. This somewhat compensates for the increase in the interest rates.

Conclusion

Factors such as increased foreign investment, impressive performance by bonds and improved structural reforms augur well for strong interest and surging investor appetite for bond issuance from the GCC region. However, there are certain concerns that might impede the growth of issuances. Primary among them is the absence of regional harmony which has increased credit market volatility. Embargo on Qatar and anti-corruption measures in KSA have caused shock, leading to widening of CDS spreads. Subsequent fed rate hikes by the U.S would also pose as a headwind. While the bond market ended on a positive note in 2017, the above issues need to be addressed to continue the strong performance in 2018.