GCC Banking Mergers: A second wave imminent?

November 04 , 2020

Request Full Report Download Executive Summary Download Executive Summary

Executive Summary

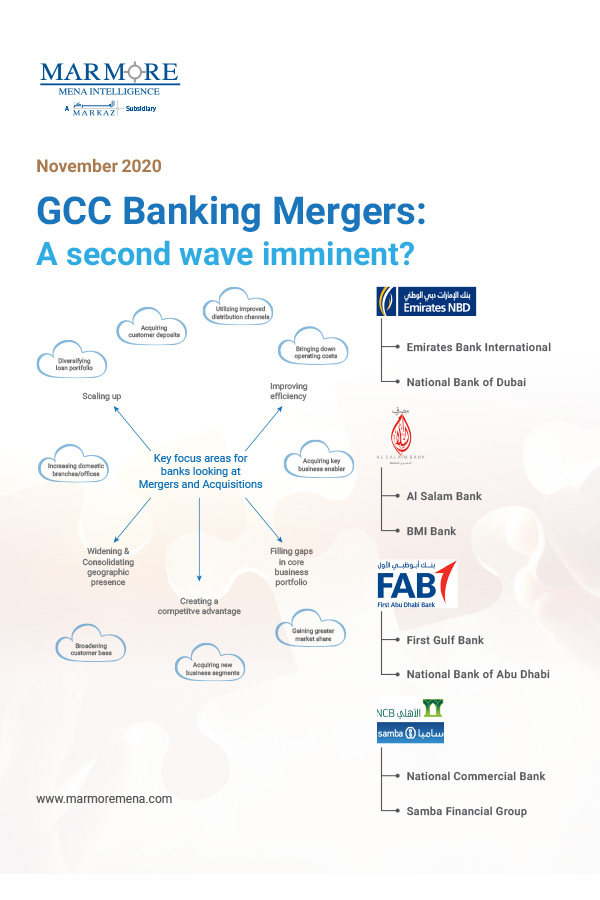

The GCC banking sector, which has been dormant in terms of major M&A activity over the past two decades, has seen a sudden surge in M&A related announcements since 2017. Another wave of banking mergers in the GCC is likely to be triggered in 2020 as the coronavirus crisis has severely altered the global economic landscape. The dual challenge of low oil prices and the slowdown in economic activity will hit the profitability of GCC banks due to shrinking net interest margins and deteriorating asset quality.

Although mergers theoretically provide several benefits to the merging banks, the banking industry, and the economy, history suggests that not all mergers end up being successful from the shareholder perspective. Analysing some of the major GCC banking mergers in the past throws light in this regard and provides valuable insights on what to expect from upcoming mergers.

Key Highlights

- Another wave of banking mergers in the GCC is likely to be triggered as the COVID-19 crisis has severely altered the global economic landscape. The dual challenge of low oil prices and the slowdown in economic activity will hit the profitability of GCC banks due to shrinking net interest margins and deteriorating asset quality.

- Although mergers theoretically provide several benefits to the merging banks, the banking industry, and the economy, history suggests that not all mergers end up being successful from the shareholder perspective.

- Analysing some of the major GCC banking mergers in the past provides valuable insights on what to expect from upcoming mergers.

Table of Contents

- Overview

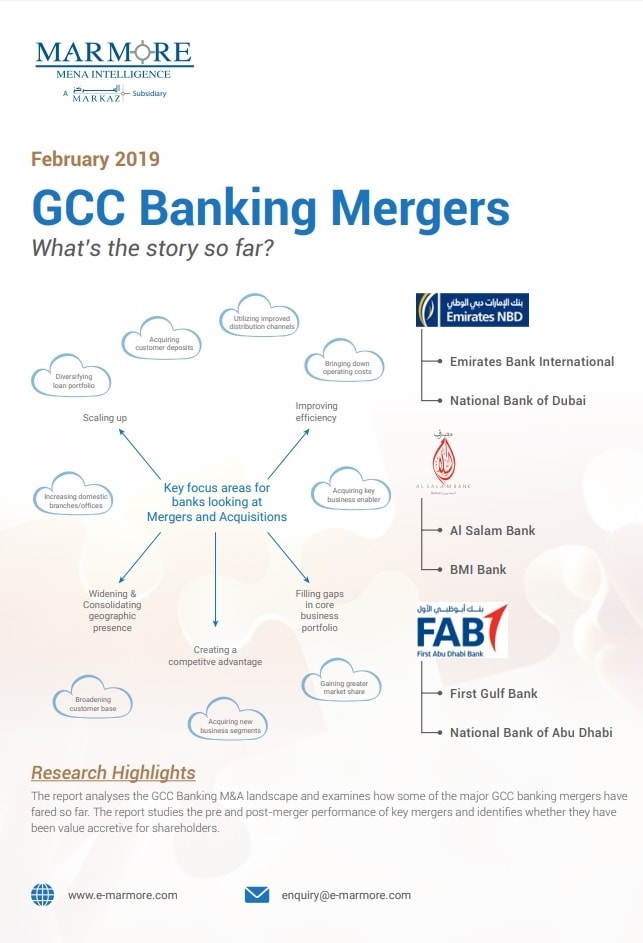

- Why do banks opt for mergers and acquisitions?

- GCC Banking Merger Wave

- Case Studies

- Conclusion

- Appendix