Executive Summary

A monthly publication that covers the performance of GCC and global Capital markets (Equity & Fixed Income)

Key Trends

- GCC markets were down in October, with the S&P GCC Composite index falling by 4.8% which can be attributed to the rising geopolitical tensions in the Middle East.

- Kuwait index fell by 5.2% in September. The fall was broad-based, with all sectors ending the month in negative territory except Technology and Insurance.

- Developed market equities declined in October, with MSCI World and S&P 500 indices losing 3.0% and 2.2% respectively

- Oil prices fell by 8.3% for the month despite geopolitical tensions in the Middle East owing to the partial lifting of the export ban on Russia coupled with concerns over global oil demand.

Table of Content

- Asset Class Monthly Performance

- Equities - Kuwait

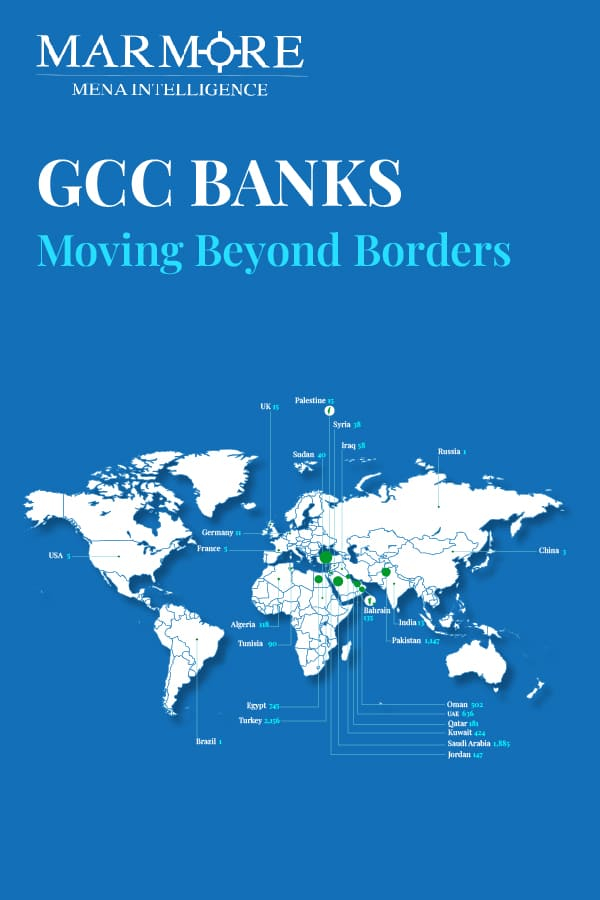

- Equities - GCC Markets

- Equities - Developed & Emerging Markets

- Fixed Income - GCC & Developed Markets

- Oil Market

- Cryptocurrencies