Oil revenues & private sector growth to speed up GCC economic recovery in 2022

Marmore Team

08 September 2021

As the world charts its recovery from COVID-19’s impact, businesses and trade around the world begin to hit normalcy, reviving the global demand for oil and consequently the global oil prices. As of August’21, price of IPE Brent is up nearly 41% year to date. OPEC+ is firm on its stance of cutting oil production until mid-2022, this is set to support global oil prices and provide renewed vigour for GCC economies. According to Institute of International Finance (IIF), the hydrocarbon real GDP growth rate in 2022 is expected to touch 5% with hydrocarbon revenue within the GCC region increasing from $221 bn to $326 bn in 2021.

In 2020, as Oil prices hit multi-year lows, the governments of the GCC countries stepped up on the diversification path via the private sector with special emphasis on the Small and Medium Enterprises (SMEs). The policy rates are deemed to remain accommodative, in a bid to enhance credit to the private sector, to enable full economic rebound. (Saudi Arabia eases regulation to support SMEs and Entrepreneurs)

The GCC governments have made investor friendly transformations in the legal and regulatory framework governing foreign investments. In a bid to increase the ease of doing business, UAE has allowed full foreign ownership of the onshore companies without the need for an Emirati shareholder or agent. Kingdom of Saudi Arabia issued record number of foreign investor licenses in Q1 of 2021, marking a 36.2% annual increase, with foreign investment in Saudi stock market up by 150% in Q2’21 as compared to 2018. Saudi Arabia is also witnessing a healthy growth in start-up funding, jumping from $8mn in 2016 to $150mn in 2020. (Foreign investment in Saudi stock market up by 150%)

The non-oil real GDP growth rate for GCC countries in 2021, with Oman as an exception, is estimated to touch 3% as per the World Economic Outlook report of the IMF. Despite positive outlook for both oil price and private sector, the risk of slow vaccination rollout, delta variant and new restrictions by the states in response to it, looms large on the GCC recovery.

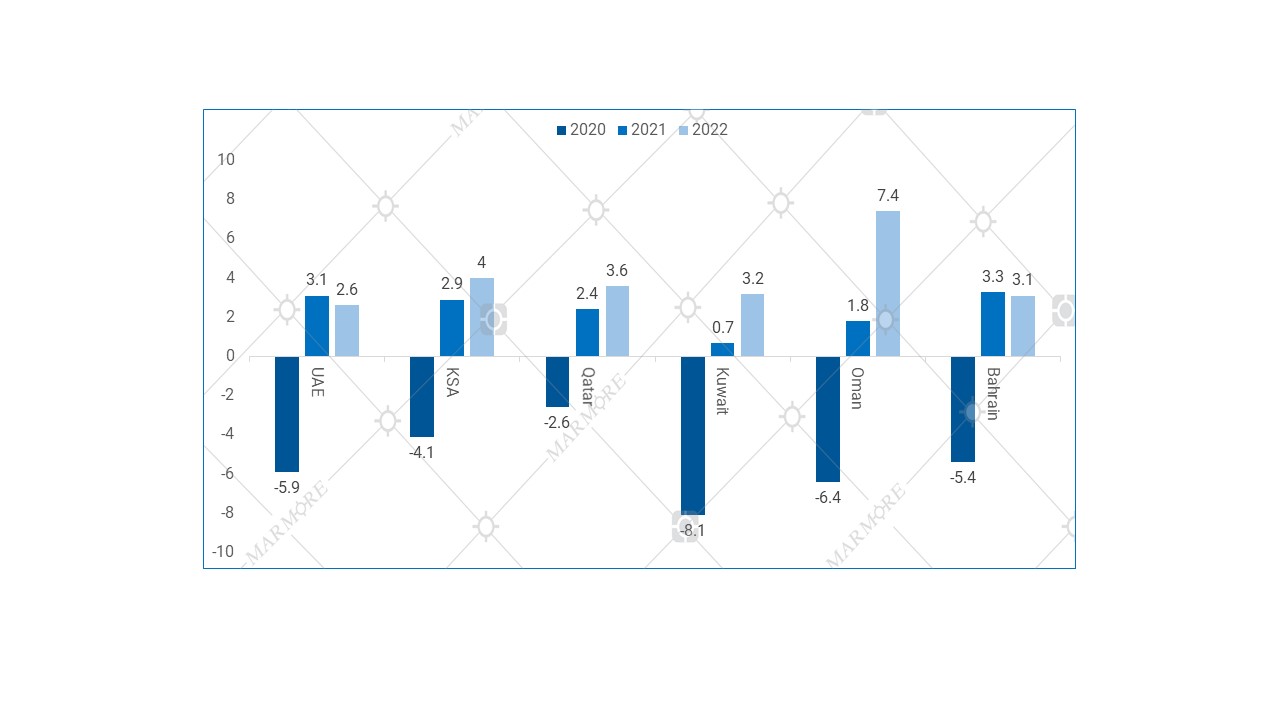

Real GDP Growth Forecasts (in %)  Source: World Economic Outlook report, IMF

Source: World Economic Outlook report, IMF

The article is an excerpt from our “Global & GCC Capital Markets Review: August 2021” report. Read more

Stay Tuned To Marmore MENA Insights!

Never miss a patch or an update with Marmore's Newsletter. Subscribe now!

Related Article

The uptick in MENA Eurobond issuances – A sign of things to come?

MENA debt issuances have touched record highs in Q1 2025. Will the uptick continue in subsequent quarters?

Read MoreKuwait’s Approval of Public Debt Law: Re-emerging on Investors’ Radar

Kuwait has passed the long-awaited debt law in March 2025. The blog explores the importance of the law, the expected benefits and outlook for the countrys return to debt markets.

Read MoreThe Dynamic Rise of Fintech in the GCC

The convergence of technology and finance is reshaping the GCC Financial Ecosystem. The blog explores key players, regulatory framework and market dynamics of Fintech in the GCC region.

Read More