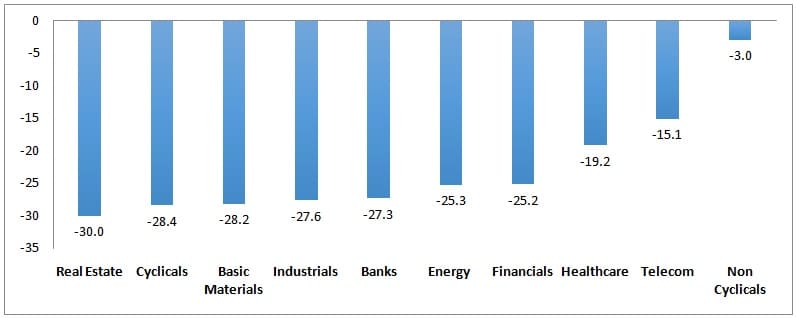

As the COVID-19 pandemic continues to cast its shadow far and wide, businesses across sectors are likely to be negatively impacted. This has also reflected in equities, as stocks across sectors have taken a hit.

Exhibit: GCC Indices and their YTD (in %)

Source: Refinitiv; Note: Data as of 25th Mar 2020. Cyclicals includes Hospitality, Tourism; Basic Materials includes Construction; Industrials includes Aviation, Logistics.

While initial concerns were of a spill over effect from China, the virus’ spread across regions, including GCC, has caused both demand and supply side shocks. As the contagion continues to spread, the actual impact on sectors and economies would depend on its duration and intensity.

Based on the developments so far, the following sectors are likely to be most affected in GCC.

Real Estate and Construction

Decreased demand in real estate would affect the sector in the near term. In countries like UAE, where oversupply had been a concern before the virus outbreak, the impact might be compounded. However, once the virus threat abates, the residential sector might recover sooner aided by government measures such as Abu Dhabi’s waiver of real estate registration fees and low interest rate environment. The downside for residential real estate is the unemployment trends that may prop up if the virus persists.

Social Distancing and lockdowns have caused closure of malls, offices and other commercial spaces. Many landlords are giving tenants the option of delaying rent payments. There is a call for rent freeze from commercial tenants. These measures might weigh on landlords’ revenues and erode credit quality. Trends sparked by COVID-19 like work from home at scale and increased online shopping might impact demand for office and retail spaces in the long run.

From availability of construction materials to labour shortages and work stoppage to contain coronavirus spread, construction sector is being struck from multiple angles.

Energy

Hit by the double whammy of lower demand due to virus outbreak and oil price war, the energy industry is one of the most affected sectors. Energy was also one of the earliest sectors to be impacted. Even when the outbreak was limited to China, with it being the largest importer of oil, demand was expected to fall and oil prices started declining. The demand is expected to fall by about 15-20 million barrels per day in the next few weeks(Estimates by Goldman Sachs, Vitol and IEA). The uncertainty in outlook because of virus’ spread and historically low prices have led to oil majors across the world slashing their expenditure budget.

Travel and Tourism

One of the first measures taken by countries to contain the spread was to impose travel restrictions. This has hurt aviation and hospitality industry at its core. In airlines and hospitality, time is an important component in service delivery. While in goods, higher demand at a later might compensate for current decrease, it is not the case in service based sectors. Demand once lost is an opportunity gone by.

In the week from 9th -16th March 2020, airlines in Saudi Arabia and UAE had reduced capacity by 15.3%(Visual Capitalist). International Air Transport Association has projected that airlines in the middle east are facing a 2020 revenue loss of USD 19 billion, with the revenue loss around the word estimated at USD 252 billion. CAPA Centre for Aviation has estimated that most airlines globally will be bankrupt by the end of May without coordinated government and industry action. Airlines are reportedly taking measures such as salary cuts and cancelling or postponing 2019 dividends.

Cancellation and postponement of events have cemented the decrease in demand in hospitality. Travel restrictions have led to free fall in occupancy rates and in turn revenues. Hotels are reportedly closing bookings to tide over these tough times. The magnitude of impact is still a question with expectations of it being on the higher side.

Banking

As businesses across sectors face the heat, given their credit exposure to other sectors, banks would not remain unscathed. A host of factors from weakening credit profile of borrowers, probable increase in NPAs, lower interest rates in the near term to measures such as deferring loan repayments might affect bank’s profitability. Lower oil prices and potential slowdown in economic growth may slow down banks’ credit growth.

Healthcare

Healthcare is the sector most intertwined with COVID-19. As the number of cases increase across countries, healthcare is swamped with COVID-19 patients in most countries. Outpatient departments are closed and planned surgeries have been postponed, leading to revenue loss for healthcare providers. Inadequacy of healthcare infrastructure – from basic protective gears to sophisticated equipment – is under spotlight as even developed countries with advanced health care systems struggle to cope with the crisis.

Education

With schools and universities asked to shut down, online learning has gained traction. From advanced apps to basic video platforms, education ecosystem is trying to make online learning work as seamlessly as possible. This might change the way the sector works in the long run. Education technology providers would stand to gain from this change. COVID-19 scare may be a deterrent for students to study abroad as it might affect perceptions of personal safety, reducing foreign student numbers at the institutions. However, as countries would take efforts to improve their health systems, this might not be a long term trend.

The suddenness and speed of the virus spread has added to the magnitude of the blow to businesses. While some are optimistic over pace of business revival once the COVID-19 scare passes, there is a downside risk that prolonged virus spread might push the world into recession. With the coronavirus curve flattening out in some countries, there is hope that this health crisis shall soon pass. Once it does, fiscal measures and favourable interest rates would provide adequate support structure as demand revives and sectors rebound.

This article has been published in our Monthly Market Review for April 2020.

Stay Tuned To Marmore MENA Insights!

Never miss a patch or an update with Marmore's Newsletter. Subscribe now!

Related Article

2024 Kuwait Banking: Interest Rates and NIM Trend Analysis

The blog discusses how net interest margin of Kuwaits banks has moved across interest rate cycles, in light of awaited policy rate cuts.

Read MoreAre ESG and Sustainable investing the same?

ESG and Sustainable Investing might seem to be related but both are distinct concepts. The GCC nations transition towards cleaner energy portrays a buoyant outlook for ESG and sustainable investing.

Read MoreBusiness Impact of IFRS Sustainability Standards for GCC

The impact of the recently issued IFRS sustainability standards, once adopted, is likely to be high, as GCC companies scramble to allocate adequate resources for the adoption.

Read More