Automobile is an essential part of the lifestyle of middle east citizens and hence forms an important component of GCC’s annual imports. The region enjoys higher ownership of automobiles primarily attributable to per capita income above the world average.

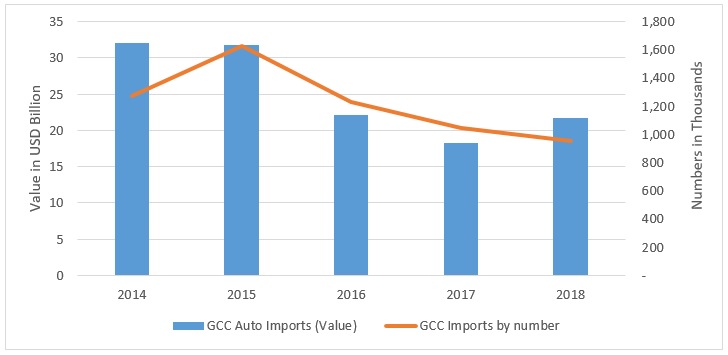

Middle East imports, often fluctuates with oil prices and so is the case with automobile imports too. But what is noteworthy is the sharp decline in imports of automobiles by value and more particularly by number of vehicles during 2016 and 2017, with no signs of reversal in 2018. Automobile imports by value shrunk (-)16% in 2016, while imports by number shrunk (-)24.4% in 2016. Though the decline in imports by value recovered (+0.4%) in 2017 (and grew by 18% in 2018), imports by number continued to further decline by (-)16.9% in 2017 and (-)8.9% in 2018 respectively. In 2018 the automobiles or passenger car net imports accounted for USD 22 billion or about 4.2 % of total imports of goods of USD 522 billion by the GCC countries (they accounted for 5.5% of imports by value in 2014). What could have been the reasons for the slump is a matter of discussion and analysis for all stakeholders?

GCC Auto Imports Slump (by Value and by Numbers)

Fluctuations in oil prices could have been the reason for the slump in demand, but the data reveals a contrary trend, which indicates that the auto demand continued to decline despite recovery in oil prices in 2017. Other factors possibly responsible for the slump may include the below:

– Demand Cyclicality that is characteristic of the Industry in GCC.

– Demographic Changes that are happening in GCC.

– Lower Replacement demand as automobile imports 10 years back were low.

The above factors have been discussed in detail in our report “GCC Automobile Sector” and “Shift to Electric Vehicles – How will it impact GCC Automobiles Sector”. We have also delved deeper to find the key growth drivers and challenges that the Industry faces and have also forecasted the automobiles demand for the coming years.

Stay Tuned To Marmore MENA Insights!

Never miss a patch or an update with Marmore's Newsletter. Subscribe now!

Related Article

The uptick in MENA Eurobond issuances – A sign of things to come?

MENA debt issuances have touched record highs in Q1 2025. Will the uptick continue in subsequent quarters?

Read MoreKuwait’s Approval of Public Debt Law: Re-emerging on Investors’ Radar

Kuwait has passed the long-awaited debt law in March 2025. The blog explores the importance of the law, the expected benefits and outlook for the countrys return to debt markets.

Read MoreThe Dynamic Rise of Fintech in the GCC

The convergence of technology and finance is reshaping the GCC Financial Ecosystem. The blog explores key players, regulatory framework and market dynamics of Fintech in the GCC region.

Read More